World-class tax departments realize that a tactical approach to the provision—just getting it done and out the door—is no longer enough. Companies expect Tax to deliver a nearly faultless provision that provides insights to help the organization understand ETR and cash tax drivers.

Learn from the approach these tax departments take to make their provisions more strategic. Start with these three steps:

1. Reduce Reconciliations to Minimize Risk

2. Improve Process Transparency

3. Bridge Top-Down and Bottom-Up Thinking

Step 1. Reduce Reconciliations to Minimize Risk

Many tax professionals lose substantial time chasing down info for provision. Manually moving and reconciling data aren’t valued-added exercises; they’re tactical and time-consuming steps needed to ensure accuracy. Do questions like these add value to the business?

- Does this spreadsheet/column equal that spreadsheet/column?

- Does PTBI tie to financials?

- Is data consistent from period to period?

Reducing manual tasks to validate data helps Tax shift their focus to big-picture thinking:

- What’s the ETR and what’s driving that rate? Is it higher than expected, lower, or what we anticipated?

- How can Tax recognize and address shifts in tax expense before they happen?

- What impact on future periods will uncertain tax positions have?

- Are we well-positioned to accommodate last-minute changes such as re-classes and topside adjustments?

- Which tax planning strategies should we consider regarding international operations and foreign investments?

To transition from a tactical to strategic approach, Tax should:

- Reduce the need to move data across multiple systems

- Reduce manual data reconciliation

- Use tax system tools to automate validation

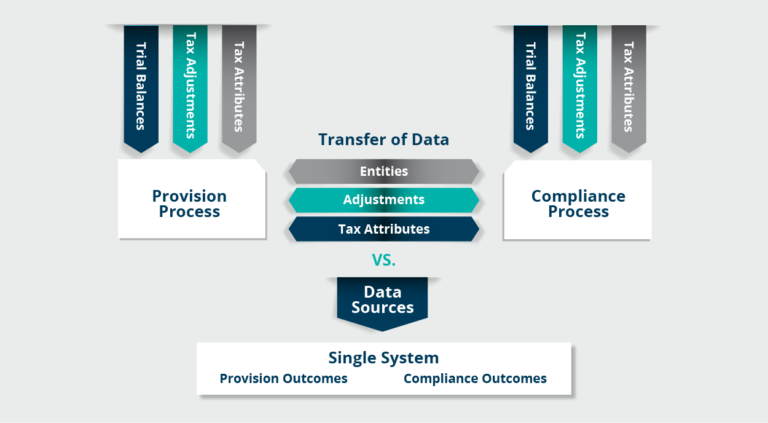

This requires understanding and synthesizing all data sets. A key cause of reconciliations is using different tools to accomplish different tasks. Many tax departments’ toolsets look something like this:

Data movement in disparate systems vs. one tax system

Tax teams spend valuable time manually investigating discrepancies, while reconciling data from multiple systems and inputting that data into different spreadsheets. Because the data isn’t shared from one system to the other, once provision ends and compliance starts, further reconciliation issues emerge in the true-up. Preparers also reuse provision data for returns. Time is lost moving provision data to a separate system for compliance needs, most likely in a different format. Further, working with disparate data sets requires continuous reconciliation and leaves a large margin for error and associated risk.

So, what do world-class tax teams do differently? They arm themselves with solutions that harness and standardize data from various sources, preempting the need to reconcile minutia. To the extent source data is different, they use system tools to validate those sources. Once freed from the reconciliation cycle, Tax spends time analyzing data, uncovering anomalies, and developing tax strategies that support the organization’s business goals.

Step 2. Improve Process Transparency

A huge effort goes into the provision to produce a valuable financial result in a short time. Leading companies ensure they build transparency into the process for visibility. Seeing all components of the provision reveals potentially untapped opportunities—as well as possible risk.

A dashboard helps tie everything together. In fact, a single dashboard can unite data, documents, and workflow in an organized manner, so that multiple people can use it to collaborate and share information.

Improved process visibility helps in two ways. It allows you to track financial metrics, such as year-over-year ETR and cash taxes. Both provide insights into your tax picture. It also helps you know whether deliverables are on schedule, so you can redeploy resources to meet critical deadlines, if needed.

As the tax team moves through the provision workflow, it should identify strategic insights in real time:

- Which processes can be performed independently of others?

- Which processes are dependent on others?

- How long does the provision take from beginning to end?

- Which activities can be eliminated in a time crunch?

- When can we free up workflow resources to work on other tasks?

Step 3. Bridge Top-down and Bottom-up Thinking

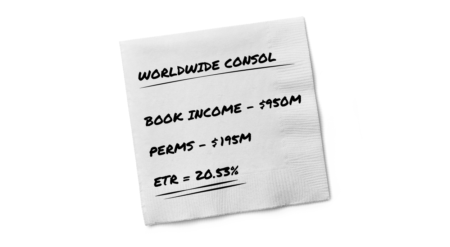

Based on their knowledge of expected company changes and planned transactions, finance and tax execs have a “top-down” understanding of the company’s ETR for the year. They calculate their estimate in a spreadsheet or even on the back of a napkin. Despite being sometimes ad hoc, it’s a means for senior management to evaluate the expected impact of income taxes on the financials.

As the year progresses, the “bottom-up” or detailed provision is calculated on actual results.

Having visibility into actual ETR drivers as early as possible, as compared to an estimated ETR, enables stakeholders to account for fluctuations in net income due to a rising or falling ETR.

This early visibility allows important business decisions to be based on a more accurate effective rate. This is crucial because having a more accurate calculation sooner improves budgeting and planning—and should be part of the overall provision calculation instead of an offline process.

By bridging the top-down and bottom-up processes seamlessly within a single model, you can map the transaction-based actual detail to the business-driven, high-level forecast. This ensures that the actuals reflect the largest potential rate drivers: transfer pricing adjustments, mergers and acquisitions, and any major permanent differences, to name a few. With these significant items working in tandem as actuals and forecasts, accuracy compounds for the current—as well as next year’s—forecasts.

Instead of a “back of the napkin” approach, the provision can be the starting point for determining ETR.

Summary

Transitioning your approach to provision from tactical (just get it done) to strategic (insights that reduce risk and increase profitability) adds important perspective and the opportunity for smart planning. To add strategic value, consider reducing reconciliations to minimize risk, improving process transparency, and combining a top-down/bottom-up approach to forecasting. Together, these strategies empower tax teams to proactively and positively influence the bottom line.

See provision time, risk, and labor savers in action! Watch the on-demand webinar: Corptax Provision Automation—4 Ways to Win Back Time

about this topicAbout Mike Lemons

CSC Corptax® Sales Enablement Manager Mike Lemons uses his extensive experience in corporate tax to help tax teams reach unprecedented levels of productivity, profitability, and success using Corptax technology.