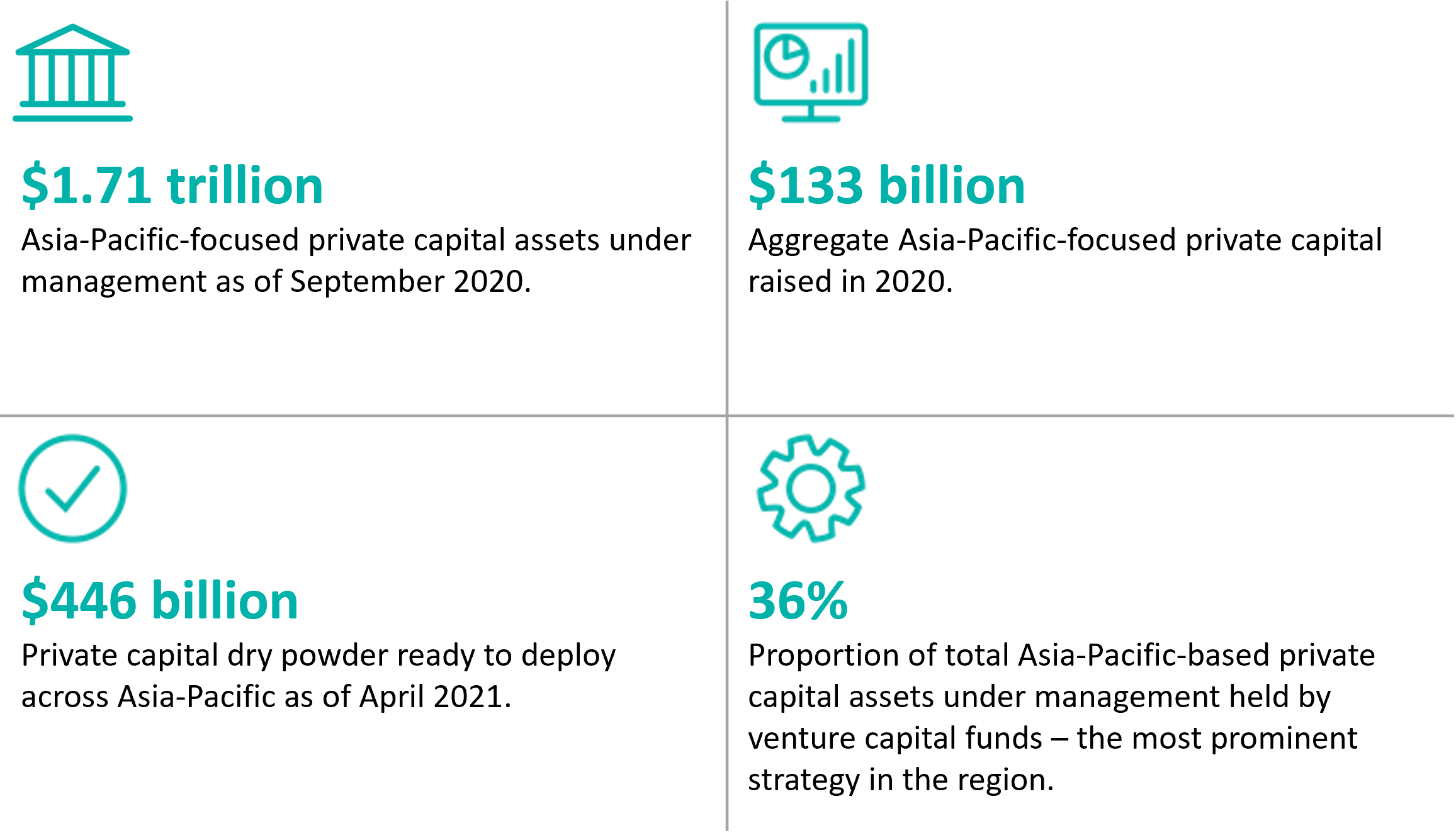

With the divergence of economic growth predictions across regions, it’s not surprising that many private capital firms are re-evaluating their geographic footprint. Whether this is a realignment of internal resources, or pursuit of new market expansion, Asia Pacific (APAC) has once again become a hot region for growth. It is forecasted that private capital assets under management (AUM) in APAC, excluding RMB-denominated funds, will represent 12.7% of the global market at the end of 2022, reaching $2.25 trillion by 2026.[1] RMB funds, on the other hand, have been issued since 2005 and are currently gaining popularity following the lifting of restrictions for foreign companies setting up funds in mainland China. In July 2022 the number of managed funds was 135,836, an increase of 2,039 (1.52%) compared to June. In the same period,[2] the size of the funds grew by RMB 420.09 billion to RMB 20.39 trillion, an increase of 2.1%.

Despite this significant growth, navigating APAC’s private capital market remains complex. There are 48 countries in the region–each with unique local customs and investment landscapes. It is imperative that new market entrants understand the environment before setting up new funds or entities and investing in the region.

What are we seeing in the APAC market?

Inflation rates globally increased from 4.71% in 2021 to 7.4% in 2022.[3] APAC has so far avoided the worst of the inflationary impacts seen elsewhere in the world, increasing from 3% to 5.6%[4] year-over-year, given the more measured monetary and fiscal policies from authorities in response to the pandemic. On top of this, countries such as Singapore offer an attractive corporate tax rate, tax exemptions for newly incorporated businesses, no tax on dividends, and an extensive network of tax treaties, making it a business-friendly jurisdiction.

Despite lower inflation, statistics show the ranks of the middle class in APAC are swelling fast, as are the institutions managing their savings and surplus capital.[5] According to China’s National Bureau of Statistics, around 400 million Chinese are categorized as middle income–which is generally defined as a family of three earning between RMB 100,000 and RMB 500,000 annually. China accounts for half of the planet’s middle class and their growing purchasing power is a source of opportunity for foreign businesses across a wide range of sectors. At least 58% of Chinese households are likely to be mass affluent or above by 2030.

One of Asia’s strengths, digital and mobile technologies, accounts for a large regional share of global growth in key technology metrics over the past decade. Australia has a thriving tech sector and its fintech industry ranks sixth in the world and second in the Asia Pacific region. As a result, it has grown as a hub for tech investment in critical areas including finance, regulation, medicine, and education.

Fund structures in APAC

Apart from offshore fund structures, it is not uncommon for fund managers expanding into APAC to set up funds using local fund structures. There are multiple structures to choose from in various locations each with its own benefits. Here are some of the fund structures in APAC:

| Domicile Country | Fund Structure | Structure’s Benefits |

| Australia | Managed Investment Trust (MIT) | Commonly used structure for widely held (offshore) investor base Fully-regulated fund vehicle, suitable for an institutional investor base |

| China | Qualified Foreign Limited Partnership (QFLP) | Provides ease of foreign exchange settlement in specific investment areas Wide range of investment types and exit options Flexible in fundraising from different investors (foreign and domestic) |

| Hong Kong | Limited Partnership Fund (LPF) | Simple, straightforward regulatory framework May not be charged capital duty or stamp duty imposed on proceeds arising from the distribution of profits |

| Singapore | Variable Capital Company (VCC) | Used for open- and closed-end funds and can be adapted to traditional and alternative sectors Allows investors to vary their share capital without having to seek shareholders’ approval Allows for segregation of assets and investment strategies under the same umbrella As a distinct legal entity it may access double-taxation agreements |

Why choose a third-party fund services provider?

Expanding into new APAC jurisdictions can be extremely complex. Depending on resources available to support the process, the variety of countries and their diverse legal frameworks can be daunting. Funds considering entry into APAC may face these challenges:

- No existing presence in the new jurisdiction or the region

- Limited awareness of local rules, regulations, or requirements

- Little or no back-office support function or infrastructure

- Need for recruiting or transferring employees to new entities in new jurisdictions

- Managing the complexity and requirements of the various partners, authorities, and regulators involved in establishing a new presence

Additionally, where companies do have an existing presence, they often struggle with streamlining management of operating entities outside their home region and the significant time involved in keeping those entities compliant. With these challenges in mind, how do fund managers plan to expand efficiently and successfully in APAC?

Using a third-party fund services provider not only provides economic substance for non-APAC fund managers but provides a trusted partner who understands the region and can handle the complexity of regulatory compliance, risk management, and other services.

| Main challenge | Our solution |

| Navigating local customs and investment landscape. | Our expert teams offer fund managers deep local knowledge to get them up to speed in a new jurisdiction. |

| Numerous required service providers can be difficult to manage. | We provide end-to-end solutions for fund managers launching funds in APAC, under one brand with one service standard. |

| Lack of local support functions make accessing APAC markets independently costly and time-consuming. | We provide a third-party fund administrative service solution with existing infrastructure in place offering faster entry to the market. |

Case study

Our client, a private equity firm based in the United States, was considering its first international expansion into Asia Pacific.

For the expansion, the client identified key employees to drive their APAC strategy and selected a candidate to relocate to Singapore. However, with no experience in the region, this proved to be a challenge.

Our team in Singapore assisted with expediting paperwork for the incorporation of their new entity and followed through by securing an Employment Pass (EP) for the candidate. The client hit the ground running and went about building out the infrastructure for their APAC operations.

Our team then helped the client establish and launch their Singapore VCC fund which is now successfully invested into private equity and venture capital opportunities in Southeast Asia.

How can CSC help fund managers?

CSC’s experts leverage their experience in the industry to help you make the most of your data, optimize your workflows and understand the role technology plays in your business’s success. As you continue to grow and expand your investment strategies in multiple jurisdictions, you need to address regulatory and compliance requirements, ensure tight due diligence, and provide increasingly transparent reporting to meet your investor demands.

When you partner with us, we help you take care of your portfolio’s fund administration, and underlying investments and the subsequent data aggregation. We regularly assist our clients with technology-driven solutions and continually develop new products to meet their objectives, while reducing reliance on in-house operations.

The CSC advantage

- As a strategic partner, we offer a full-spectrum of services tailored to meet back-office needs throughout a fund’s lifecycle against a background of ever-increasing reporting demands.

- Our proprietary innovative technologies combine with global knowledge and experience to deliver added-value services for all asset classes, while increasing manager visibility of portfolios on behalf of a fund’s investors.

- Our expert teams harness tools and cutting-edge technologies to eliminate costly errors in fund administration and corporate actions, investor relations and portfolio management.

[1] https://www.preqin.com/insights/research/reports/preqin-2022-alternatives-in-asia-pacific

[2] https://www.amac.org.cn/researchstatistics/report/gmjjhybg/

[3] https://www.statista.com/statistics/256598/global-inflation-rate-compared-to-previous-year/

[4] https://www.statista.com/statistics/1325670/inflation-rate-continent/

[5] https://www.preqin.com/insights/research/reports/preqin-markets-in-focus-alternative-assets-in-asia-pacific-2021