CSC Corptax® Sales Engineer Carrie Ivicic helps clients streamline tax work and planning with Corptax technology. In the interview below, Carrie explains “agile tax planning” and shares a use case where it paid off in time, risk, and cost savings for the tax team and company.

How has Tax changed regarding planning?

Tax today is a whole lot different than it was ten years ago. It used to be about deadlines: getting work off your desk for one deadline, then getting work out for the next one, and so on. But now, it’s a completely different game.

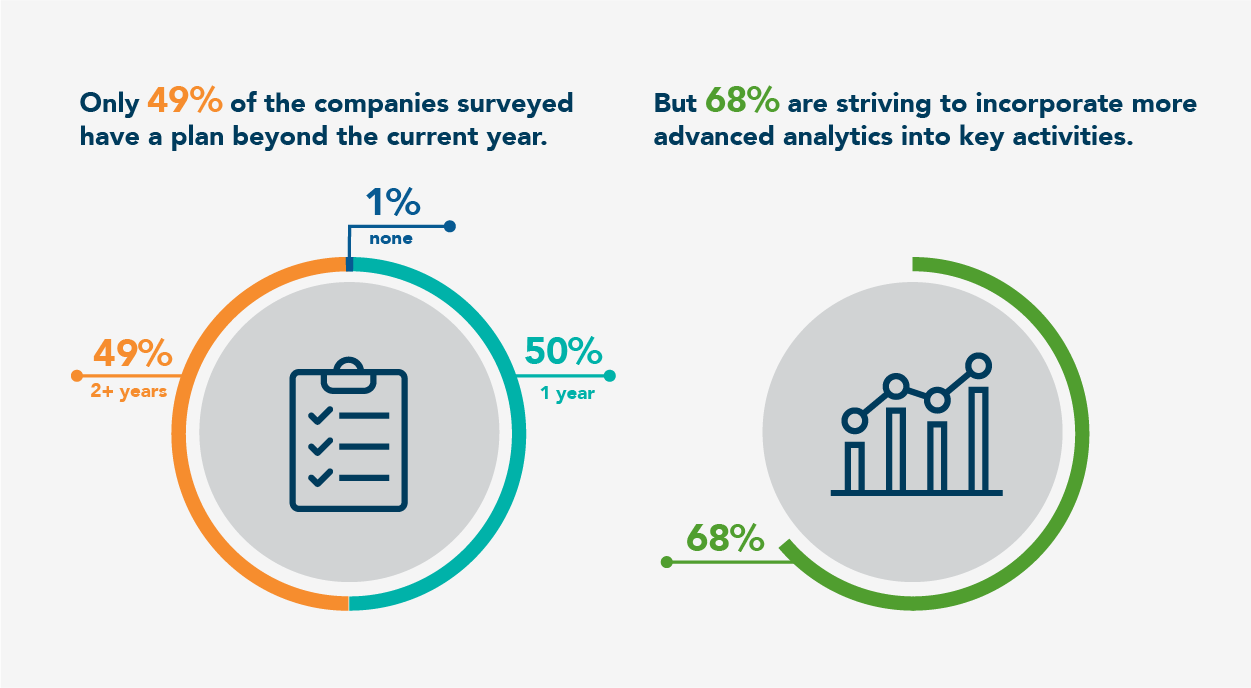

Below is a metric from an EY study that supports this. The study found only 49% of companies surveyed feel they have a plan beyond the current year. That really hit home with me because I hear the same story when working with clients and prospective clients. Most say the need to do more planning is critical. They want to look at what-if scenarios and plan for changing tax laws and dissolutions and acquisitions. They want to analyze trends and what’s happened over time. They don’t have the right tools, and they’re not sure where to start, so they’re looking for ideas. That’s where agile tax planning comes into play.

What is agile tax planning and what does it look like?

The goal of agile tax planning is to gain a deeper understanding of your data by conducting studies, running hypotheticals, spotting trends and anomalies, and drawing data-based conclusions. It’s looking at your present situation and evaluating changes, so you’re dealing with fewer unknowns, and you’re more prepared.

On a broad scale, it can mean looking at proposed legislation and weighing what-ifs. More narrowly, it’s measuring the impact of moving a factory or employees from Point A to Point B. Or, if a domestic company acquires a company with global operations, you know what to expect.

Here are a few popular examples of agile tax planning:

- Feasibility studies—We prove whether or not it would be worth changing a filing method, for example

- What-if analysis—We take a dataset and say, “What if this happens?” and layer on those changes

- Trend analysis—We analyze data over time to see patterns or oddities, like a high ETR for an entity

- Rolling forecasts—We project tax law, industry, organizational, and other changes, and view their impacts over time

Can you walk us through an agile tax planning business use case?

Sure thing. Corptax client, Chicago-based Curran Group, wanted to automate processes to get time back for planning—and leverage automation to do that planning as well.

They started by leveraging CSC Corptax® Office—an Excel add-in. Office allows users to pull data from Excel and push it into Corptax—and vice versa. You can pull out massive amounts of data in an instant and reuse it for tax processes, analytics, and much more.

So for compliance, Curran Group pulled out their federal and state adjustments, analyzed them, and made changes. They had all of the current adjustments in Excel, and they simply pushed them into Corptax.

That allowed them to reuse data and rules used in Corptax. They could compare prior-year to current-year to see if anything looked incorrect.

Also, they automated their extensions and estimates. This enabled them to get that data into Corptax so they could simply e-file that information and also furnish the U.S. Census Bureau with data for surveys. Surveys used to take the team up to 20 hours per survey. Now, they simply use queries to pull that information, and they get the data in mere seconds.

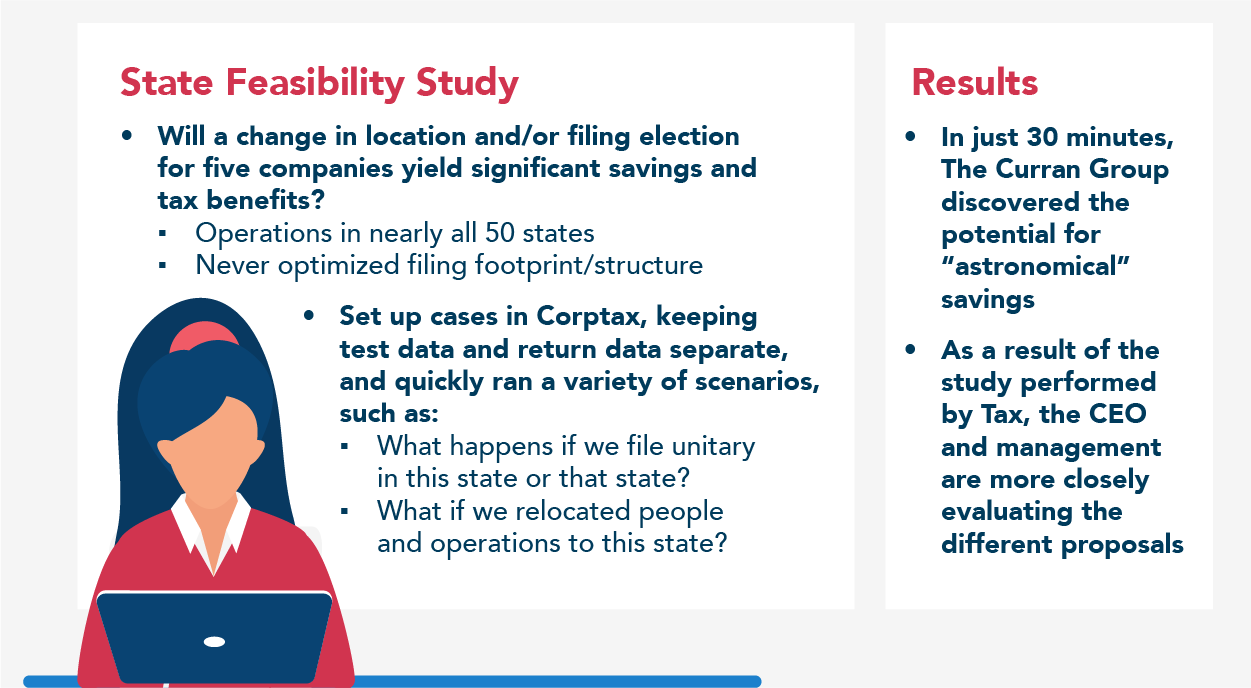

Next, the Curran team wanted to understand the significance of company location and state filing method on state tax liability, so they used Office to pull related data from Corptax to do extensive scenario testing.

They set up individual cases, too. Cases are just sets of amounts in Corptax. You have the flexibility to keep test data separate from return data as you use it.

By quickly extracting specific information, changing some of the inputs, and pushing it into Corptax, they were able to answer questions around hypotheticals like, “What if we file unitary in this state or that state or stay separate? What would the impact be for each?” Or, “What happens if we relocate people, and their salaries are in a different state?”

What was the final outcome? And, any key learnings?

The feasibility study took Curran Group just 30 minutes, and they were astounded to discover that the potential for savings was huge. They presented their findings to the controller and CEO, who were equally surprised by the cost differentials. As a result of that study, Management is evaluating different proposals.

Curran Group felt the speed with which Office facilitated the analysis made the study possible, telling me, “If it hadn’t been so fast, we might not have attempted the study to figure it all out. Corptax Office made all the difference.”

Tax technology made the analytics and planning fast and easy for Curran. They were able to apply critical thinking and create tangible value for the company:

- ~$10,000 saved based on feasibility study

- Feasibility study performed in 30 minutes vs 25 hours

- Minutes vs. hours extracting data needed for multiple U.S. Census surveys

The moral of the story: use technology to support agile tax planning—from getting the data you need to the many ways you can learn from.

In Your Shoes: 3 Tips to Streamline State Get tips to help you file timely, easily answer audit requests, and avoid interest and penalties.

about this topicAbout Carrie Ivicic

As a CSC Corptax® Sales Engineer, Carrie Ivicic works closely with the Corptax sales team and brings her extensive experience as both a customer advocate and tax technology consultant to understand and solve customer challenges. Carrie is a licensed CPA and holds a Bachelor of Arts in accounting from St. Xavier University!