Calling the last couple of years “challenging” for tax departments is putting it mildly. New tax laws had to be understood and executed in record time to meet internal and external deadlines for all reporting. Escalating data needs complicated workflows. Tax found itself pushed to the forefront with greater expectations to reconcile data dependencies and provide analyses of tax changes. And just when we thought it couldn’t get harder, we found ourselves working from home.

All this chaos highlighted gaps in processes that had served us well for years—making now the best time to evaluate your tax technology goals and develop a strategy to meet your needs.

As you begin to address your gaps, focus on minimizing risk exposure, creating efficiencies, or both. Technology gives you the ability to better control data, security, and analytics to lower risk—and the opportunity to bring major efficiencies to your processes with automation.

Adopt Technology to Address Change

Most experts agree: tax volatility is here to stay, and your solution must adapt to changes as they come without creating more disparities. The right technology acclimates to business developments, grows and contracts as requirements, forms, and filings evolve, and connects data across the organization for all departments to use.

Addressing technology gaps not only prevents risk, time loss, and missed opportunities, but ensures you:

- Meet complex data requirements

- Access all levels of data

- Eliminate workflow bottlenecks

- Strategically support C-Suite and business planning needs

Create a Foundation for Change

A solid foundation starts with common profiles to use across multiple reporting obligations. Common profiles create automation and reduce data inconsistencies by eliminating manual intervention. Corptax as a single database stores data in a consistent structure with common profiles to use across tax periods and reporting requirements.

- Establish common data profiles, including entities, adjustments, and accounts to use seamlessly across provision, compliance, and planning scenarios.

- Manage entities and their related attributes included for filing requirements in a central repository to share across the system.

- Descriptive and obligation‑related information for presentation across federal, international, state, and local forms.

- Tax status—whether an entity is a C-Corp, CFC, DRE, or partnership, and how changes evolve year over year.

- Equity and ownership information that contributes to entity groupings, calculations, and reporting.

Corptax as your foundation provides a multi‑year database with multiple scenarios, along with organizational charts defined to meet the specifications of your tax department. You maintain complete control over content and volume in one system. Data is saved in a consistent manner to provide unlimited automation from provision to compliance to planning. Easily automate provision data to reuse as the starting point for compliance, generate an automated RTP, and leverage existing data to run hypotheticals.

Reap the Benefits of Automation

Consistent common data allows you to automate processes and eliminate repetitive tasks. Because you map amount data consistently from one or many source systems using a standard chart of accounts, you import or push data into the system and post account‑driven adjustments automatically.

Take data-import a step further by automating your M and E&P adjustments and other repetitive tasks when loading source data. A data load can trigger adjustments, calculations, and printing or exporting reports en masse—all behind the scenes without intervention.

Storing of entity attributes automates entity groups, unitary state filings, and reporting requirements based on filing obligations. Ownership and equity drive automation of forms and reporting requirements to reduce repetitive steps as you e-file IRS and state forms. Reduce the need to create and manage consolidated groupings and sub-consolidations and share data between multiple taxing jurisdictions.

Understand Data Dependencies

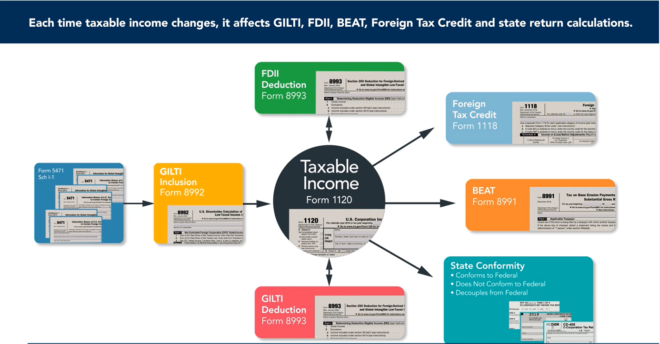

The illustration below reinforces the concept of data dependencies as they relate to various forms and calculations within the compliance process.

We start with federal taxable income presented on Form 1120, which is where our clients typically start their return process. If you have foreign operations, we need to look at how E&P is being prepared for Form 5471. Form 5471 E&P data also feeds the GILTI inclusion calculation, which impacts your FDII calculation, which impacts your 1118, your BEAT calculation, and your state calculations. You can do all of these steps simultaneously, instead of one at a time.

What does this mean for your process? Federal taxable income continues to be refined without needing to wait. You can start on other aspects of these calculations, which automatically update as you revise underlying data sources that feed forms and calculations. Once you finish the calculations, FDII, GILTI, and the foreign tax credit not only feed Forms 8992, 8993, and 1118, but also post inclusion results back to Form 1120. Sweet!

Overcome Roadblocks to Technology

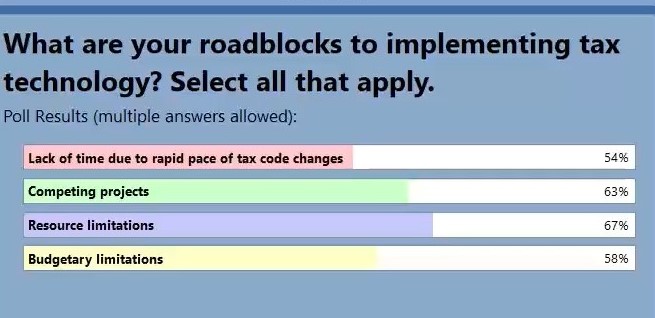

A centralized tax software system offers many benefits, including process efficiencies, data dependency management, total transparency, and fast data access, sharing, analysis, and reviews! So what stops tax teams from implementing technology and process improvements? As the survey data below shows, many cite lack of time due to the rapid pace of tax code changes, competing projects, resource limitations, and cost.

What steps can tax departments take to overcome these obstacles and build their case for tax technology?

Align goals with other departments and functions. Seek to identify common sources of data and opportunities for efficiency. For example:

- Automatically generate GL data and other financial information in a way that easily updates the tax database

- Coordinate with Legal on updates to entity information, ownership changes, and organizational charts, so all stakeholders work with one version of truth stored in the tax database

- Use data that HR already maintains for the latest regulations

Doing nothing and repeating inefficient processes comes with its own cost. Updating and reconciling offline models, scrambling to create detailed support, and spending hours and hours on audits not only drains time and strains resources, but introduces risk.

Develop a Tax Technology Roadmap

You don’t have to go all in on technology at once. It doesn’t have to be overwhelming. You can:

- Start with a process review to identify your biggest pain points and best opportunities for a good return.

- Establish a phased approach and timeline that work with the resources you have.

- Choose a project champion to own the change management process and work closely with your software company.

Consider CSC Corptax Professional Services

Many companies partner with our consultants who specialize in every aspect of the tax lifecycle, including international compliance and tax law changes. Every day, we work online or onsite with Corptax administrators, tax analysts and directors, VPs of Tax and Finance, and CFOs.

We tailor every engagement to fit our client’s goals, timeline, and budget and ensure you’re fully autonomous before we conclude our work. Some of what we do includes:

- Guided-to-full implementation support or anything in between

- Best practices for automation, business processes, and workflows

- Data analytics optimization

For more information on getting started with a tax technology plan, call 800.966.1639 or email info@corptax.com.

Interested in a demo of benefits discussed in this blog post? Watch the on-demand webinar Bridge Gaps with Game-Changing Technology!

about this topicAbout Donna Culver

Donna Culver has been with CSC Corptax® for 20 years. As a Senior Director on the Professional Services team, she helps Midwest clients optimize their tax processes using Corptax solutions.