We sat down with Mary Ellen Robb, Corptax BEPS Country-by-Country expert, to learn how she helped an international company address offline database dilemmas around CbC and GMT data.

Who is the customer?

A global food and beverage company and long-time Corptax customer with 600+ reporting entities doing business in 90+ jurisdictions worldwide.

What did the customer want to improve regarding their CbC data?

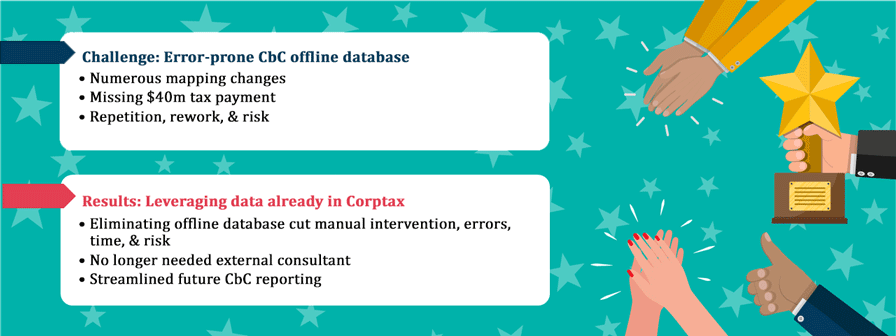

The company housed all their supporting BEPS CbC data in an external database. As with most offline databases, the team had to manually collect and load data, such as trial balances, and make adjustments without considering data adjusted for compliance purposes. This resulted in duplication, inconsistencies, and errors in the offline calculations.

To eliminate those issues, they wanted to compile their CbC report using proven federal and US international return data already in Corptax. They also wanted to use that data for their GMT planning model—instead of data in an Excel file that didn’t align with their as-filed compliance data. In short, they wanted data consistency across federal, international, and CbC reporting as well as their GMT planning model.

What steps did you take to assist the team with their CbC data?

First, we replicated the prior year by comparing sourced and filed data side-by-side with data already in Corptax. Every account balance and even certain transactions were reviewed to ensure correct treatment and/or mapping to the CbC report previously filed.

From there, the fun began.

The analysis revealed a number of discrepancies, from missing accounts and balances to the overall treatment of accounts. They also noted a $40 million tax payment that didn’t appear in their offline model.

Based on these findings, we updated the data collection packages (the source of their international trial balances) and ensured the correct account mapping existed for both CbC and compliance reporting. We also created a series of CbC-specific adjustments to track and manage any data movement from the original trial balance.

Once we identified and resolved prior year data issues, it was time to review current year CbC data. Corptax Office was key to this process. We leveraged Corptax POV reports to pull CbC Table 1 amounts out of Corptax, used Excel Power Query to organize and review the data, and then used Corptax Office to push adjustments identified during the review process back into Corptax.

Success! The current year CbC report was filed using the Corptax compliance dataset. By using vetted data already tracked in Corptax, the team eliminated their offline database and calculations.

They not only saved time but set themselves up for fast, accurate, and complete CbC reporting going forward. Plus, they no longer needed an outside consultant to compile data, run the database, and provide reports from a Table 1 perspective.

How did the team redeploy existing Corptax data for Global Minimum Tax work?

The team was calculating potential top-up taxes offline—this time using an Excel model—and only layering in a few key adjustments. As with their CbC reporting, they wanted to leverage their Corptax dataset for GMT planning, too.

We started by comparing their offline results to results produced in Corptax. To begin the process, we performed the standard setup items and ensured all entities were included in the reporting group.

Now—and this is key to the process—we used the same dataset used for compliance and CbC reporting, which contained all the mapping updates we performed after the CbC review discussed above.

This data was then consumed by the GMT process. As part of the initial review, there were no additional adjustments made to top-up tax reports outside of data currently residing in Corptax.

The Corptax process identified those countries whose ETR was less than the 15% minimum tax, and it computed the respective top-up taxes. We compared the Corptax report to their offline report and guess what? The same countries were identified!

The best part of the story: for their major jurisdiction that produced the largest top-up tax, (let’s call it 15 million dollars) the results between Corptax and their offline model were within a few thousand dollars. And I actually said, “I am going to call this rounding when we are dealing with such large amounts!”

What’s next for the customer?

Now, the customer is confident their offline models and Corptax agree. They are researching and identifying allowable adjustments and defining where to gather data that wasn’t collected and analyzed as part of any prior process. As they review Corptax data, they’re making sure it’s flowing to the correct adjustment line in the top-up tax reports.

And as the overall GMT process continues to evolve, the GMT module will evolve, as well. Any manual effort to update offline calcs will be eliminated, reducing overall risk. They now look to Corptax as their single source of truth.

Need to optimize BEPS CbC reporting? Watch a 5-minute video with great tips.

about this topicAbout Mary Ellen Robb

In addition to her role as a lead software engagement senior manager, Mary Ellen Robb cohosts the annual Corptax Tax Transformer Awards.