We sat down with Leah Huber, GE Appliances Senior Tax Manager, to learn how her department transitioned from outsourcing tax processes as a brand new tax team to managing their tax lifecycle in-house with tax technology.

Tell us a bit about GE Appliances, a Haier Company.

Tell us a bit about GE Appliances, a Haier Company.

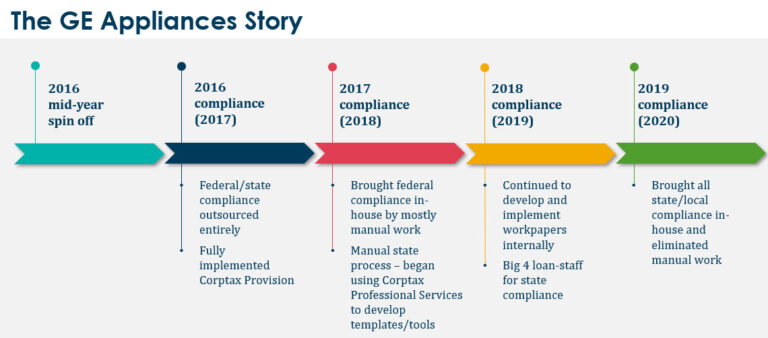

We (GE Appliances) were spun off from General Electric in 2016 and acquired by Haier Company. We’re a privately held appliance manufacturer headquartered in Louisville, Kentucky with operations or employees in nearly every US state.

We have a simple structure: a C Corp holding company with seven operating subsidiaries, one partnership, and a few disregarded entities under our main operating company. This means our small team of ten people files an 1120, 1065, a handful of 5472s, and about 100 state and local filings.

What steps did you take after the spinoff?

The spinoff left us without a tax compliance team or in place to handle our tax processes and obligations—and the timing was right before compliance season. So, we had no choice but to completely outsource compliance for tax year 2016.

In 2017, we began to build our own team and started working with Corptax to implement Corptax Provision which we completed in 2017. None of us had Corptax experience, so we were learning the system from scratch.

Before we knew it, the next filing season was upon us, and our federal team brought compliance back in house. With limited time, we only automated our trial balance upload into Corptax and manually entered most everything else. Because we didn’t yet have a solid process around importing data, we had overrides.

We decided to engage outside help to get our returns out the door. We discussed using accounting firm loan-staffing again, in spite of its drawbacks. But as luck would have it, we were working closely with Corptax on implementation at that time, and in the course of conversation, sought their advice.

They said, “we do loan-staffing,” and explained that third parties would continue to hard key numbers and not optimize our processes. That made the decision for us. We knew the best way to advance and take full ownership of what we were doing was to use Corptax for loan-staffing as well as implementation. And that turned out really well. We were able to engineer processes to streamline return prep with tax automation and, at the same time, become fully independent for the future.

So, by the 2018 compliance season, we had gone from nothing to doing our provision and federal compliance in-house with Corptax. Next, we decided to take back state compliance a little sooner than planned. We knew we wanted to use Corptax to its fullest, so we consulted with Chris Kayondo from Professional Services. He showed us great ways to get information into the system with Corptax Office. He helped us build templates to take workpapers containing summary information and import that data into Corptax at the push of a button. It saved us an incredible amount of time and was instrumental in filing returns that year and in making us fully independent going forward.

And even though I was state-focused at the time, we used Corptax Office to accelerate our federal compliance as well—pushing in items beyond the trial balance. So, Corptax Office helped our whole process.

What benefits did you experience becoming self-sufficient?

By owning and controlling our information, we’ve been able to learn from it. We wanted to be more than a function that simply prepares returns. We wanted to really dig into the data and see opportunities, and if down the road we have any M&A activities, be prepared. If we turned over our data to an external party, we felt we would lose that ability.

How was the overall experience?

We learned the system, generated huge time- and cost-savings, and now fully control our data. I think of our experience in two phases. Phase One was the decision to engage Corptax Professional Services and focus on process automation. We built standardized templates to push data into Corptax hands-free. We reduced our state compliance hours by almost 50% and eliminated the need for outside help, saving money, year over year.

In Phase Two, we took things further. We built out workpapers to automate all intercompany eliminations, reducing time spent by another 15%. So, our experience was very productive.

Any final words?

Just to add that Corptax CONNECT was so valuable. It helped us understand and get comfortable with the system’s capabilities. It’s truly a hands on conference; it’s pretty neat to walk in and see 200 computers in a room with everyone clicking along. You also get to interact with peers and see what they’re doing to improve their processes. You meet people you can reach out to if you ever hit a snag. And I always leave CONNECT with new ideas to try—so it’s a big help at the beginning and beneficial as we’ve grown.

Get the GE Appliances story from the Corptax consultant’s perspective.

about this topicAbout Leah Huber

A CPA, Leah Huber joined GE Appliances after ten years in public accounting at Forvis. Her current role includes managing state and local income tax compliance and all short and long term cash tax forecasting. Leah was also a 2022 Tax Transformer Awards finalist.