An outsourced shadow accounting firm can provide many of the services associated with traditional fund administrators. However, outsourced shadow accounting and traditional fund administrators coexist and often complement each other within the same operational ecosystem. Both functions serve different roles but can work synergistically to enhance transparency, accuracy, and overall fund performance.

How the partnership works: different functions, same objective

Traditional fund administrators handle essential functions such as Net Asset Value (NAV) calculations, investor reporting, compliance, and regulatory filings. They provide the official records that are used for external reporting to investors and regulators.

Shadow accounting is often conducted by a separate, outsourced provider to create an independent, parallel record of the fund’s financial activities. The shadow accountant verifies the records maintained by the traditional administrator to ensure accuracy, validate calculations, and reduce the risk of errors or fraud.

In this setup, the fund administrator focuses on executing core administrative tasks, while the shadow accountant provides an additional layer of scrutiny and oversight. This division of labor improves the accuracy of fund accounting and enhances investor confidence. Here are some specific ways this partnership improves fund operations:

1. Verification and error reduction

One of the key roles of outsourced shadow accounting is to verify the data generated by traditional fund administrators. For example, shadow accounting firms independently calculate NAV, distribution waterfalls, and other key figures to ensure that the primary administrator’s numbers are accurate.

This reduces the risk of discrepancies in reporting and ensures that any errors or irregularities are identified before official reports are issued to investors. By working in parallel, shadow accounting acts as a control function to catch errors, particularly in complex fund structures with numerous transactions and counterparty agreements.

2. Enhanced transparency and trust

In complex fund structures, such as hedge funds, private equity, or real estate, investors value transparency. Outsourcing shadow accounting creates an independent verification layer that improves the transparency of fund operations.

Institutional investors are increasingly demanding independent oversight to ensure accurate and unbiased financial reporting. The presence of both a traditional fund administrator and an outsourced shadow accountant reassures investors that proper checks and balances are in place.

This coexistence builds trust between the fund managers and their investors, especially in environments where counterparties, regulatory bodies, and investors demand more detailed reporting.

3. Handling complexity in multi-prime and multi-asset environments

Many alternative funds today operate in multi-prime environments, involving complex transactions with multiple counterparties and asset classes. This complexity can make fund administration challenging.

Traditional fund administrators typically handle core fund accounting tasks, but shadow accountants specialize in tracking and managing the complexities of margin calls, collateral calculations, and counterparty relationships. Shadow accountants bring specialized expertise in these areas, often working with advanced technology platforms to manage and report on intricate transactions.

In such cases, the fund administrator and shadow accountant work in tandem, with the shadow accountant focused on validating high-risk or high-complexity transactions that require additional scrutiny.

4. Scalability and operational efficiency

Outsourcing shadow accounting can help a fund scale its operations without burdening the traditional fund administrator with additional responsibilities that might dilute the quality of service. For example, shadow accountants can handle functions like reconciliation across multiple portfolios, validation of complex derivatives, and tracking multiple sets of books.

This allows the traditional fund administrator to focus on its core tasks while outsourcing specialized or high-volume functions to shadow accountants. The result is a more scalable and efficient operation.

How a complementary partnership between outsourced shadow accounting and fund administration enhances fund management

In summary, outsourced shadow accounting and traditional fund administration can not only coexist, but also complement each other effectively. Traditional fund administrators focus on core functions like NAV calculations and investor reporting, while shadow accounting provides an independent layer of verification and validation, enhancing transparency, reducing errors, and improving trust. By working in parallel, these two roles provide a more comprehensive, accurate, and scalable solution for fund managers, especially in complex alternative investment environments.

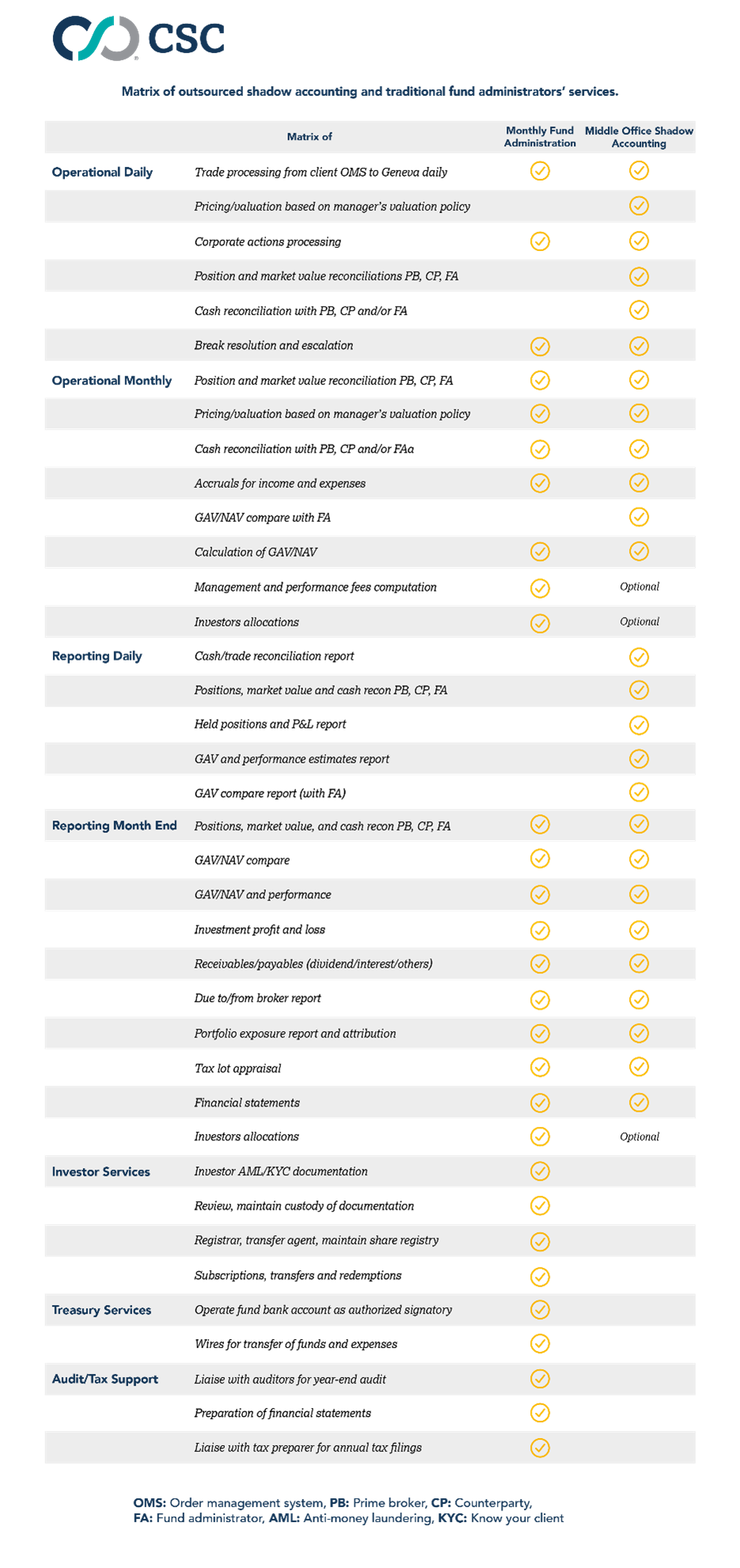

If you’re ready to move beyond traditional monthly fund administration, you may need help identifying the right mix of services. The matrix below will help you identify what’s important to you and the type of firm that can satisfy your needs.

Matrix of outsourced shadow accounting and traditional fund administrators’ services

How CSC can help

CSC’s shadow accounting services help firms meet growing expectations by providing the oversight and transparency that enables them to monitor, control, and reduce risk while ensuring they’re not bound to service providers and won’t need to increase internal headcount or infrastructure.

Our dedicated team of global experts has deep understanding and expertise across asset classes and fund accounting, managing some of the most complex investment strategies and fund structures in the industry for the world’s largest funds. Our team strives to provide unparalleled service and delivery with our accounting offerings. We take time to understand your business requirements, identify problems, and proactively address them to further your success.

Find out more about the benefits of outsourcing shadow accounting for fund managers in an increasingly complex investing and operating environment. Download our recent insight report, Enhancing Operational Efficiency: Outsourcing Shadow Accounting.