On 12 November 2020 the Cayman Islands’ Department for International Tax Co-operation (DITC) issued an industry advisory update relating to Economic Substance (ES) matters. We have outlined a summary of the update which includes the release of sample ES return forms, extension of upcoming ES reporting deadlines and sector specific ES guidance.

Sample ES Return Forms

The DITC has provided links to the following sample ES Returns:

- A sample ES Return Form for Pure Equity Holding Companies

- A sample ES Return Form for High Risk IP Companies

- A sample ES Return Form for an Entity Tax Resident in Another Jurisdiction

- A sample ES Return Form for all other Relevant Activities

The information required by the Sample Forms will be submitted via the DITC Portal once it is open. Users of these ES Return Forms may refer to these notes, which explain the purpose of the Returns and Form, and provide a high-level overview of the required data points.

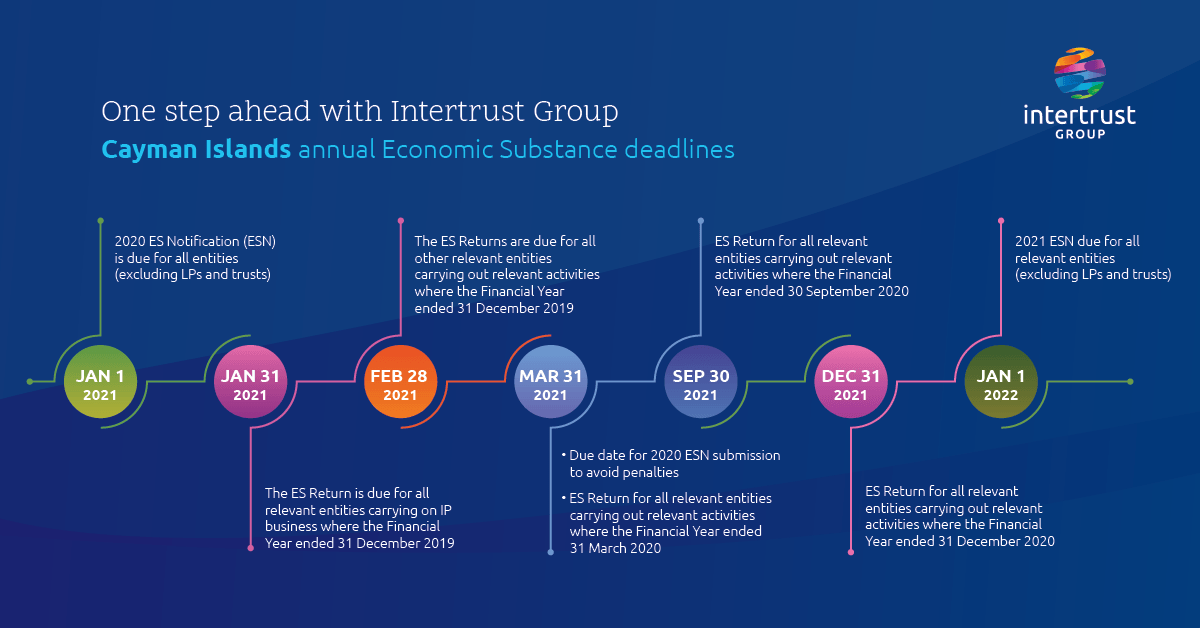

Reporting deadlines for submitting the ES Return Forms have been extended, only for this first year. The deadlines are:

- For Relevant Entities carrying on IP business who were due to file on or before 31 December 2020: 31 January 2021

- For all other ES Returns including the Form for Entity Tax Resident in another jurisdiction: 28 February 2021

These extended deadlines only apply to businesses with a financial year ending on 31 December 2019. Going forward, the reporting will be required within 12 months of the end of the applicable financial year.

It is imperative that any entity that is required to submit an ES Return Form do so before their applicable deadline. The ES legislation imposes a late filing penalty of USD 6,098 and an additional penalty of USD 610 for each day during which the failure to file continues.

Guidance on Core Income Generating Activity (CIGA) for each type of relevant activity

On 13 July 2020 the DITC issued version 3.0 of the Guidance Notes relating to the ES Law. The Guidance Notes address certain important aspects of the ES Law’s economic substance requirements, their practical implementation and include sector specific guidance for each relevant activity.

How Intertrust Group can assist

Our team of professionals in the Cayman Islands has been working closely with our clients since the implementation of the ES Law in January 2019. We can help you navigate through the ES Law and related Guidance Notes, and offer bespoke solutions should you need to comply with the ES Law including:

- Provision of independent directors based in the Cayman Islands

- Company formation and implementation

- Registered office and annual substance reporting

- Accounting and financial statements preparation

- Corporate administration services and board support services

Please contact us for assistance.