Tax transparency has become ubiquitous. Since the leak of the Panama Papers in 2016, the global call for greater transparency of offshore tax structures has intensified. In particular, DAC6 disclosure requirements increases the transparency of private wealth holding structures in a Member State.

On 25 May 2018, the Council of the European Union (EU) amended Directive 2011/16/EU informally known as ‘DAC6’ (Sixth version of the EU Directive of Administrative Cooperation). DAC6 is the requirement for the reporting of European transactions or arrangements which are defined as ‘tax aggressive’ with an EU crossborder element by intermediaries.

Notwithstanding Brexit, it’s anticipated that the UK will implement the Directive in to UK legislation by 1 July 2020.

The Crown Dependencies aren’t part of the EU so don’t fall directly under DAC6’s remit yet. In a further show of compliance and cooperation, they’ve announced that they’ll introduce the legislation by the end of the year that implements mandatory disclosure rules aligned to DAC6.

REPORTING REQUIREMENTS

DAC6 requires EU intermediaries to file information on Reportable Cross-border Arrangements to their local tax authorities. Where the intermediary asserts legal professional privilege or no EU intermediary is involved, the EU taxpayer has an obligation to self-report. Failure to submit will result in penalties.

If there are no intermediaries that can report, the obligation is on the taxpayers.

HALLMARKS – WHAT’S A REPORTABLE ARRANGEMENT?

An arrangement will be reportable if it meets at least one of five hallmarks, which are categorised as follows:

- Generic hallmarks linked to the main benefit test

- Specific hallmarks linked to the main benefit test: this includes certain tax planning features, such as buying a loss making company to exploit its losses in order to reduce tax liability.

- Specific hallmarks related to cross-border transactions (some of these hallmarks are linked to the main benefit test)

- Specific hallmarks concerning automatic exchange of information and beneficial ownership

- Specific hallmarks concerning transfer pricing

‘MAIN BENEFIT’ TEST

The ‘main benefit’ test means that one of the main objectives of the arrangement is to obtain a tax advantage.

WHO IS AN INTERMEDIARY?

A qualifying intermediary, which can be either an individual or a company, includes, but isn’t limited to, lawyers, accountants, corporate services companies, banks, holding and group treasury

companies etc.

Intermediaries, who sell reportable cross-border tax arrangements to their clients, should report information on the arrangement to the tax authorities of their home Member State.

An intermediary is also any person that provides, directly or by means of other persons, aid, assistance or advice with respect to designing, marketing, organising, making available for implementation or managing the implementation of a reportable cross-border arrangement (4).

Where there’s more than one intermediary, the reporting obligation lies with all intermediaries involved in the arrangement. In this case one unique reference number should be included on all exchanges so that they can be linked to a single arrangement.

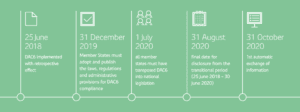

TIMELINE

PRACTICAL STEPS TO CONSIDER

It’s important that discussions between all stakeholders begin as early on in the legislative process as possible. In practical terms:

- identify what needs to be reported, who needs to report and to whom

- speak to your advisor(s) to agree who’ll be responsible for filing the information

- collate and store the data that needs to be reported

We provide mandatory disclosure reporting services, using a state of the art online reporting tool, and we’ll continue to monitor the implementation of the Directive in all EU Member States so you can focus on your business. If you’d like any further information on how we can help, or have any questions on the Directive and its potential implications, please get in touch.

(4) https://ec.europa.eu/taxation_customs/sites/taxation/files/dac-6-council-directive-2018_en.pdf