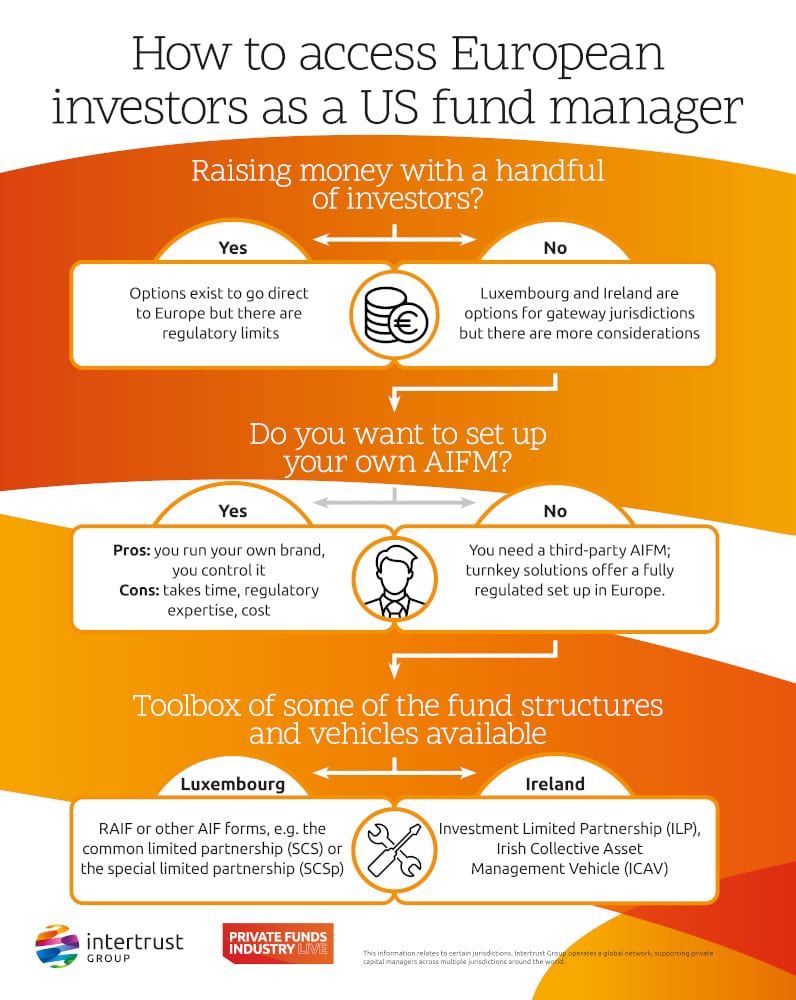

There is a toolbox of fund structures and vehicles to choose from if you are a US fund manager looking to raise capital in Europe. But first, you have a choice: whether to access investors in Europe from afar or set up a separate entity there.

If you only want to raise money from a handful of investors, you may be able to do so from a distance with your US fund by complying with the National Private Placement Regime (NPPR). But you should note that there’s a regulatory limitation to how far and where you can go. Each of the 27 member states operates slightly differently. Some allow you to enter easily, some less so and others not at all.

If you have a specific strategy for Europe where you plan to raise substantial amounts of money, you may need to set up a fund in a gateway jurisdiction such as Luxembourg or Ireland.

It is at this point that you’ll need to decide if you want to establish your own alternative investment fund manager (AIFM) or use a third-party AIFM. The advantage of operating your own is that it allows you to run and control your processes. But there are disadvantages: it can take about a year to set up, requires a good understanding of the European regulatory environment and has cost implications.

A third-party AIFM, on the other hand, offers a turnkey solution, freeing up your time to manage your fund from the US while relying on a fully-regulated set-up in Europe.

There is a wide choice of fund structures and regimes to choose from in Europe and your decision will depend on your target investors.

Luxembourg and Ireland are two of the many jurisdictions where Intertrust Group supports fund managers to navigate the complexity of constantly changing regulations and grow their business.