Maelle Lenaers

Head of Luxembourg AIFM

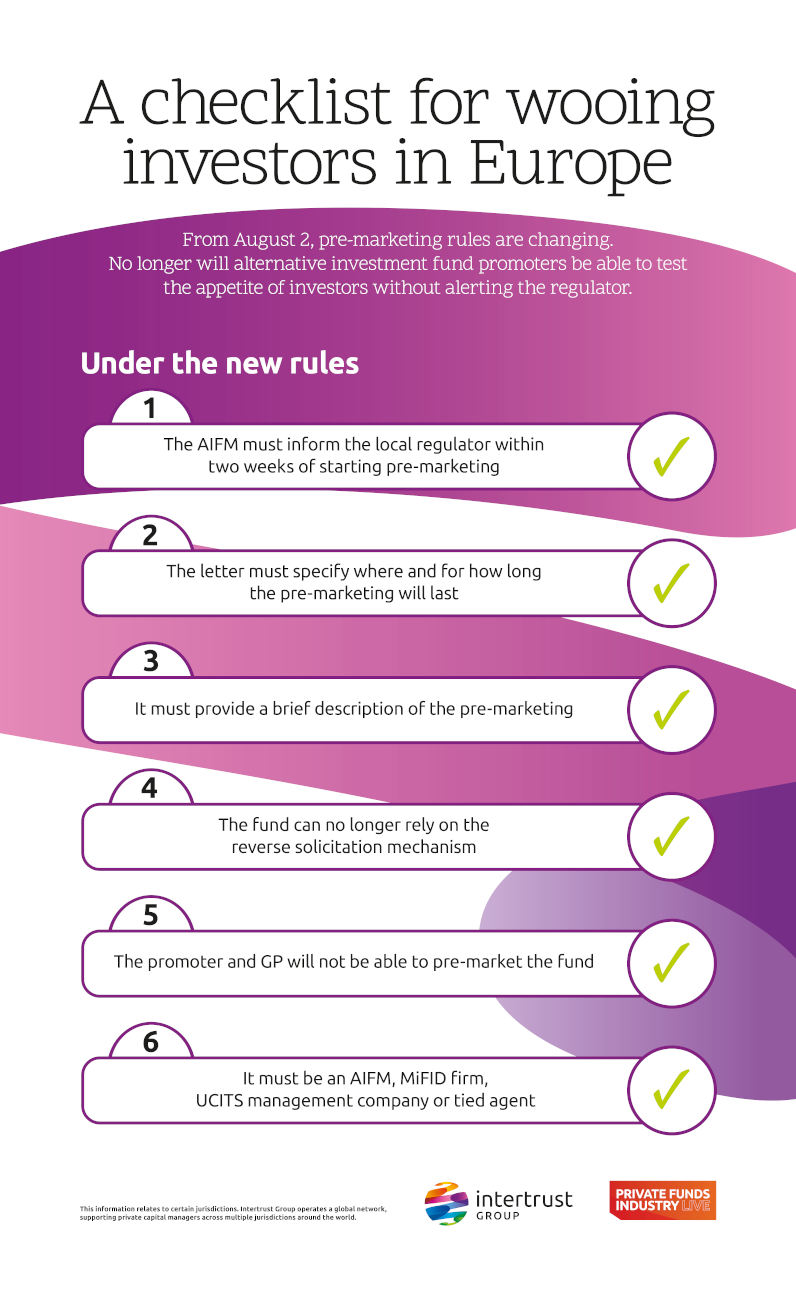

Private capital managers face an additional regulatory hurdle wooing European investors from this summer.

New rules governing the pre-marketing of alternative asset funds to institutional or professional investors in the EU will come into force on August 2.

Before, any fund promoter could check the appetite of investors without notifying the regulator. This will no longer be the case.

Under the new rules, the alternative investment fund manager (AIFM) must send a letter to inform the local regulator within two weeks of starting the pre-marketing. The letter should state where the pre-marketing will take place and for how long. It should also include a description of the pre-marketing activities and details of the funds being pre-marketed.

The use of reverse solicitation will also be affected. This is when an investor, who has not had any previous contact with a fund manager, seeks out information about potentially investing in a fund. For 18 months after an AIFM has started pre-marketing, any new subscription from an investor will be considered the result of marketing and the AIFM will need to notify the relevant regulator.

Maelle Lenaers, Head of Luxembourg AIFM at Intertrust Group, says:

You can no longer rely on the reverse solicitation mechanism and say that the investor is investing on his own behalf because you have officially started the pre-marketing.

In addition, the fund promoter and the general partner are no longer entitled to carry out this pre-marketing activity. It must be an AIFM; a Markets in Financial Instruments Directive (MiFID) firm; an Undertakings for Collective Investment in Transferable Securities (UCITS) management company; or a tied agent.

Find out more about how to demystify the operational challenges in Europe on our Private Funds Industry Live page.