The agreement will help to boost investment in Australian assets through Hong Kong. Jeremy Brugmans, Commercial Director, Intertrust Group Australia, and Quinten Kah, Commercial Director, Intertrust Group Hong Kong, outline the opportunities

New tax rules are creating exciting opportunities for investment in Australia. An Exchange of Information deal struck between the country’s government and Hong Kong authorities is set to help trigger larger flows of capital from China and other parts of north Asia.

Australia already has more than 120 of these bi-lateral agreements allowing tax details to be shared. The provision is similar to that termed a Model Agreement on Exchange of Information on Tax Matters by the Organisation for Economic Co-operation and Development (OECD). In essence, the instruments create transparency in tax affairs and help authorities address tax planning strategies such as Base Erosion Profit Shifting (BEPS). They also create competition for offshore domiciles including the Cayman Islands and British Virgin Islands (BVI).

The Australia-Hong Kong Exchange of Information pact is especially promising because it improves investment prospects around Managed Investment Trust (MIT) arrangements. Asia-based investors will have more domicile options for funds which have Australia as part of their regional or global investment strategy.

A partner company such as Intertrust Group can assist clients by digging into the details. In this context, there is an important service around possession of an Australian Financial Services Licence (AFSL), but also ensuring full administrative compliance of an MIT.

Exchange of information deal boosts Hong Kong fund hub benefits

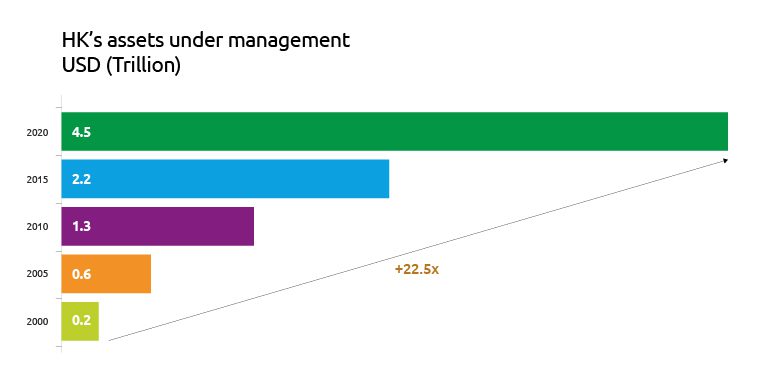

Funds managed out of Hong Kong have grown strongly in recent years. The pandemic may have temporarily cooled enthusiasm, but the long-term trend is clear.

At the end of 2020 – the most recent figures – there was USD 4.5tn in assets under management in the territory, according to data from Hong Kong’s Securities and Futures Commission (SFC). That’s more than a 20-fold rise since the turn of the century.

Fund managers using the Australia-Hong Kong Exchange of Information pact to achieve benefits comparable with (or sometimes better than) those who use the Cayman Islands or BVI. Moreover, time zone and language complications are usually fewer.

Hong Kong’s relatively new Limited Partnership Fund Ordinance (LPFO) is adding to the attractions, promoting the region as Asia’s leading private equity hub. This legislation came about after extensive consultation with Hong Kong’s asset management industry and is helping to create an environment equivalent to longer-established domicile jurisdictions.

Managed Investment Trust arrangements attract overseas investors

Since their introduction in 2008, MITs have become popular among overseas investors. They were originally created to encourage offshore investment into existing Australia-based trusts, but they have become a favoured vehicle for direct and indirect investment in Australia. Private equity asset managers are using them, and they are also attracting interest in real estate and infrastructure-related projects.

Ultimately, the aim is to drive investment activity between Australia and Hong Kong by improving returns within a clear and sturdy regulatory environment. The main MIT benefit relates to withholding tax; investors resident in a country on Australia’s Exchange of Information list enjoy a reduced rate on most distributions. The levy falls from the normal 30% to 15%. In some cases, withholding tax is as low as 10% – as in the case of a Clean Building MIT, which only holds energy-efficient commercial buildings constructed on or after 1 July 2012.

How to determine Managed Investment Trust eligibility

Aside from being domiciled in a country with an Exchange of Information agreement with Australia, investors must meet strict licensing criteria, including other qualifying MIT tests (e.g. residency, trade or business, MIS, investment management activities and the widely held tests). They need the accreditation that comes with an AFSL, which permits the provision of financial services to wholesale entities.

As holders of a wholesale AFSL, Intertrust Group can help clients who are keen to explore these new opportunities. We can also advise on other requirements for investment/asset managers and their investors, which may include overall administration and compliance of an MIT.

Intertrust Group can cover the gap while offering a range of other complementary administrative and compliance services.

Why Intertrust Group?

- We operate in more than 30 countries, with offices in Sydney, Australia and Hong Kong

- Our team is highly experienced in private capital over a variety of asset classes, including real estate and infrastructure

- We hold a wholesale Australian Financial Services Licence (AFSL)

- We offer a range of complementary administrative and compliance services such as fund accounting, investor relations and unit registry services