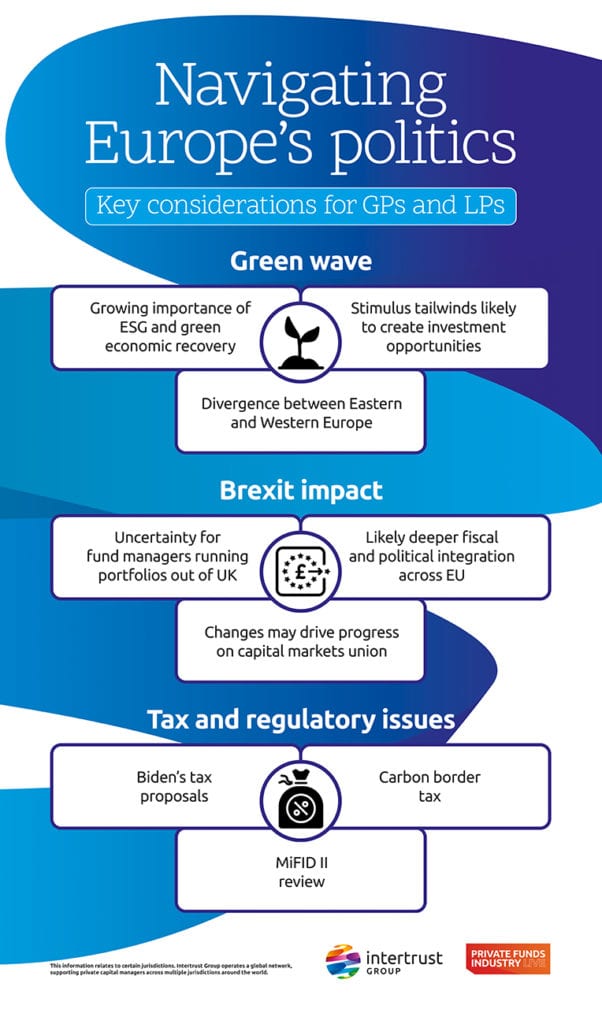

There are several political issues worth keeping abreast of as a US fund manager coming to Europe. Three likely to prove key in the near future are the green agenda, Brexit and regulatory matters.

The green agenda is a major focus for both the EU and regulators and is expected to remain a central theme in coming years.

There is a divergence between Eastern and Western Europe in terms of support for the green movement. The wealthier countries have the luxury to go green; the poorer countries often don’t.

There are a lot of government support and subsidies available to the green industry and these stimulus tailwinds will likely create investment opportunities for investors and private capital managers alike.

Equally, the financial services industry is still grappling with the impact of Brexit. Britain and the EU have struck a memorandum of understanding for a new forum for co-operation in financial regulation but it has yet to be formally concluded. This means continuing uncertainty for those managing European assets out of the UK.

But the departure of the UK from the trading bloc is expected to drive deeper fiscal and political integration across Europe. It could result in progress on the capital markets union.

On the tax and regulatory front, the financial industry is digesting US President Joe Biden’s tax proposals and how this could impact Europe.

Plans for a European carbon border tax are also in the pipeline. The European Commission is expected to present a legislative proposal on the matter by the end of July.

And amendments to the MiFID II regime are expected to be published in the fourth quarter.