On 31 August 2018, the Standing Committee of the National People’s Congress passed the amendment to reform PRC IIT Law (“the Amendment”). The Amendment was passed by the Presidential Decree No. 9, and will take full effect from 1 January 2019.

Key changes

The key changes that may affect individuals and/or companies include:

Revising the tax residence rule

The new law draws from international practice, and introduces the concept of ‘resident’ and ‘non-resident’ for tax purposes. It also modifies China’s personal tax residency rule to a 183-day test from the existing one-year test.

Reclassification of income categories

The new law groups the following four categories of labor income within the scope of “Comprehensive Income”:

- Income from salary and wages

- Income from the provision of independent personal services

- Income from author’s remuneration

- Income from royalties

Under the new laws, one set of progressive tax rates will apply for determining the IIT for this newly consolidated “Comprehensive Income” category. Tax residents will be taxed on an annual basis, while non-residents will still be taxed on a monthly basis or as-and-when taxable income arises.

At the same time, income from production or business operations conducted by self-employed persons will be reclassified as “Income from Operations”. Meanwhile, income from contractual or leasing operations to enterprises and institutions will be reclassified as “Comprehensive Income” or “Income from Operations” depending on the nature of income.

Income from operations, interest income, dividends, property leasing, transfer of assets, incidental income and other income will still be taxed separately at the rate prescribed for that category of income.

Adjusting income tax brackets

Tax rates on Comprehensive Income:

- Income under this category will be subject to tax annually instead of monthly

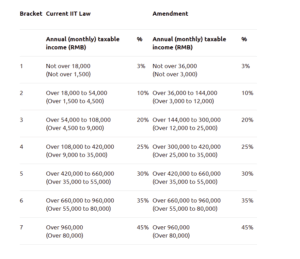

- The tax rates will be revised based on the existing rates applicable to salary and wages, i.e. widening the tax brackets with applicable tax rates of 3%, 10%, and 20%; narrowing the 25% tax bracket, and meanwhile keeping the tax brackets for three higher levels of 30%, 35% and 45% unchanged.

- Please refer to the table below for details.

Tax rates on Income from Operations

- Based on the existing tax rates applicable to ‘income from production or business operation conducted by self-employed persons’ and ‘income from contractual or leasing operations to enterprises and institutions’, Income from Operations will still be subject to progressive tax rates from 5% to 35%, with appropriate adjustments to be made to each tax bracket.

- Furthermore, there will be an increase of the lower band for the 35% tax bracket from RMB 100,000 to RMB 500,000.

Raising personal deduction on Comprehensive Income

The new law raised the personal deduction amount for Comprehensive Income to RMB 5,000 per month (i.e. RMB 60,000 per year). The new personal deduction applies to all, and the current step-up in personal deduction (i.e. RMB1,300 per month) for foreign nationals will no longer apply.

Allowing itemized deductions for specific expenditures

In addition to the current deductible items (e.g. basic pension insurance, basic medical insurance, unemployment insurance and housing fund), the new law has set up additional deductions for specific expenditures which are closely related to people’s lives. This includes expenditures on dependent children’s education, continuing education, serious illness medical treatment, housing mortgage interest and rental and elderly care expenses.

Introducing a unique taxpayer identification number and an anti-tax avoidance rule (GAAR) for individuals

The new law indicates that “one taxpayer, one number” is the basis for developing a modern IIT collection and administration system. It also makes reference to the general anti-avoidance rules under the PRC Corporate Income Tax Law, and introduced similar rules to empower the tax authorities to assess tax on individuals who are involved in transactions such as:

- Asset transfers which are not at arm’s length

- Tax avoidance by use of offshore tax havens

- Deriving inappropriate tax benefits through unreasonable commercial arrangements

Where tax is assessed, any late payment surcharge would also be collected accordingly.

Implementation

Phase 1, effective from 1 October 2018, the new tax table was implemented for:

- Taxable employment income

- Income derived from production and business operations by individual industrial and commercial household

- Income derived from contractual or leasing operations of enterprises or institutions.

- In addition, the new standard basic deduction (RMB 5000 per month) will be implemented.

Phase 2, the overall amendment will be effective from 1 January, 2019.

The revised IIT law brings significant challenges to expatriates in China with global incomes as well as Human Resources and Finance departments who manage the change. There are still some items, such as those below, which are expected to be clarified in the near future.

- According to the existing Detailed Implementation Rules of the IIT Law ( the DIR), individuals without domicile in China will not be subject to IIT on their worldwide income until after they have resided in China for five full consecutive years. It is unknown at this stage how the ‘5-year rule’ may affect the change to the definition of tax residence.

- It is still unknown if some current preferential tax rates (e.g., the preferential rate for year-end bonus) will be affected in 2019.

- According to current regulation, foreign nationals are entitled to some tax exemptions, for example dependent education and rental expenses. These may be duplicated in the non-taxable benefits currently provided by employers to their foreign national employees working in China. Companies should monitor the probable impact of the new tax deductible items and review their existing non-taxable benefits scheme relating to the new amendment.

From the expanded taxation scope of foreign individuals to the increasing compliance risks impacting enterprises, both employers and employees should prepare for challenges brought about by the new IIT Law, and pay close attention to the upcoming new Implementation Rule and revisions to other tax regulations.

The table below highlights the main changes to the taxable income brackets, especially for those taxpayers subject to an applicable tax rate of 25% or lower under the current IIT law.