The COVID-19 pandemic is set to significantly impact the financial services industry globally and the size of this impact will depend on the time it takes for markets to stabilise again. David O’Flaherty highlights how this will affect Alternative Investment Fund Managers (AIFMs), like Intertrust.

As an authorised Alternative Investment Fund Manager (AIFM), in both Ireland and Luxembourg, we provide regulatory compliant solutions to managers (both in the EU and Non-EU) that enable them to market their fund across Europe. The Alternative Investment Fund Management Directive (AIFMD) was introduced as the European Union response to the global financial crisis in the last decade.

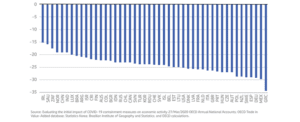

In light of the coronavirus impact, the Organisation for Economic Co-operation and Development (the OECD) is currently forecasting a slow-down in economic growth, with Ireland on the low end with under 15% and Greece at the upper end of the scale with almost 35% decline.

The potential initial impact on activity of partial or complete shutdowns on activity selected in advanced and emerging market economies.

Our AIFM business is highly regulated and the regulators, (the Central Bank of Ireland – CBI in Ireland, and the Commission de Surveillance de Secteur Financier – CSSF in Luxembourg), will communicate with funds via the AIFM. We expect the CBI and CSSF to increase their correspondence in the coming months as the situation develops and continues to disrupt markets.

There’s set to be an immediate focus for the CBI on liquid funds with retail investors however the funds we provide AIFM services to are largely illiquid. This means that while some of our funds may unwind in the medium-to-long term, there’s no short-term risk of that occurring.

As the crisis continues to unfold, we expect our AIFM teams to be increasingly busy. Some of the funds we manage have assets that will be among the impacted and the AIFM will have to monitor closely and regularly engage with investment managers, valuation agents, regulators as well as other service providers connected to the funds. Where managers are made up of a number of strategic managers, we’re hoping to see some positive activity in the short term and the addition of some new funds.

During this time, we aim to keep abreast of any regulatory changes that may be introduced. Overall, there’s a sentiment of “steadying the ship” in order to provide best-in-class AIFM services to fund managers both in the EU and outside it.