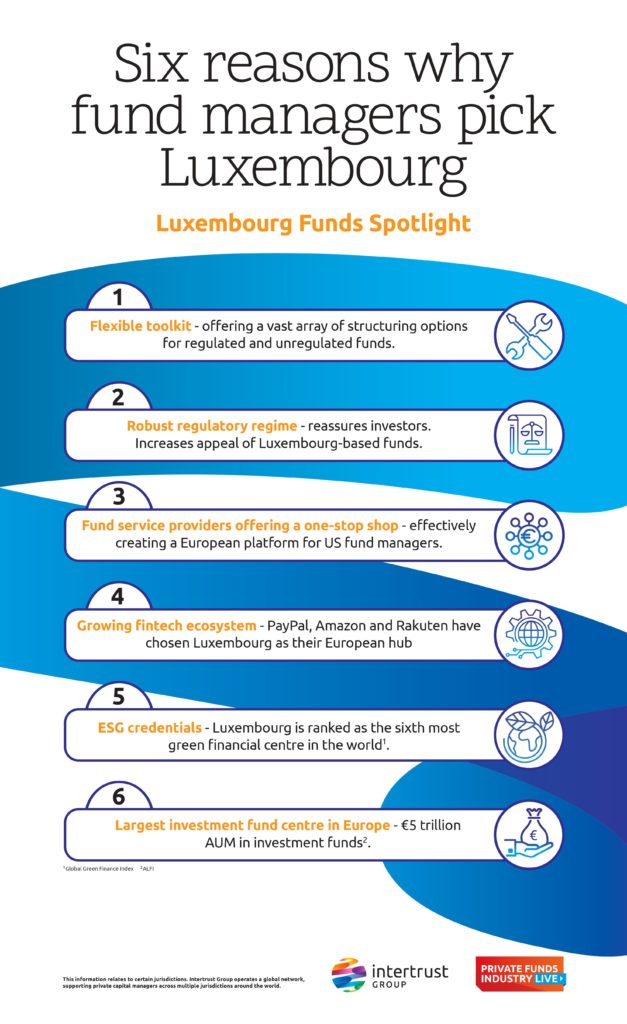

Luxembourg is the largest investment fund centre in Europe. Its assets under management have more than doubled over the past decade, from €2 trillion in 2011 to €5 trillion in 2021.

Its appeal to fund managers and investors alike is driven by a number of reassuring factors, including its AAA-rated economy, political stability and robust regulatory and compliance framework.

For US fund managers, one of Luxembourg’s biggest attractions as a jurisdiction is its famous toolbox for alternative investment funds. This has been updated to appeal to the needs of all private equity groups, regardless of where they are based. This comprehensive suite of fund structuring options offers fund managers enormous flexibility. Popular alternative investment structures include the Société en commandite simple (SCS), Société en commandite spéciale (SCSp) and Reserved Alternative Investment Fund (RAIF).

Fund services providers in Luxembourg offer GPs a one-stop shop, enabling them to outsource their administration, reporting and accounting services and to take advantage of the third-party alternative investment fund manager (AIFM) model. This eases the burden for fund managers, freeing up their time to focus on the fund’s investment strategy.

For GPs focused on responsible investing, Luxembourg boasts strong environmental, social and governance (ESG) credentials. It is ranked as the sixth most green financial centre in the world. It is also home to LuxFLAG, a not-for-profit organisation set up to bring ESG clarity to the financial sector through its labelling. Intertrust Group became a member of LuxFLAG in June 2021.

A growing fintech ecosystem also offers investment opportunities. PayPal, Amazon and Rakuten have all chosen Luxembourg as their European hub.

To find out more and discover which factors you should consider when setting up a fund in Luxembourg, watch this recording of our recent LinkedIn LIVE event: Luxembourg Funds Spotlight.