Michael Secondo

Head of Corporate and Administration Business Development, Americas

The expectations of CFOs are growing – but help is at hand to meet their growing responsibilities.

Imagine the scene: an airport lounge. (It’s more fun to imagine the post-Covid world, after all.) You spot one of your Chief Financial Officer (CFO) clients, hunched over their laptop.

The standard Brooks Brothers business casual attire has been swapped for a hoodie and jeans. Glancing up, the CFO waves you over. They are en route to a sustainability hackathon, hoping to recruit some coders and potentially a Chief Technology Officer (CTO) for one of their portfolio companies.

Today’s CFO not only looks different – they have very different priorities from those of the past.

One day they might provide the essentials of net asset value (NAV) and the profit and loss ledger. The next could be meetings on fundraising, search engine optimisation (SEO) keywords, botnets and environmental, social and corporate governance (ESG) data sets. The vocabulary, like the role, has expanded.

Help is at hand for the beleaguered CFO

Intertrust Group surveyed 300 private capital fund CFOs and their investors about the evolution of their role as demand for data grows.

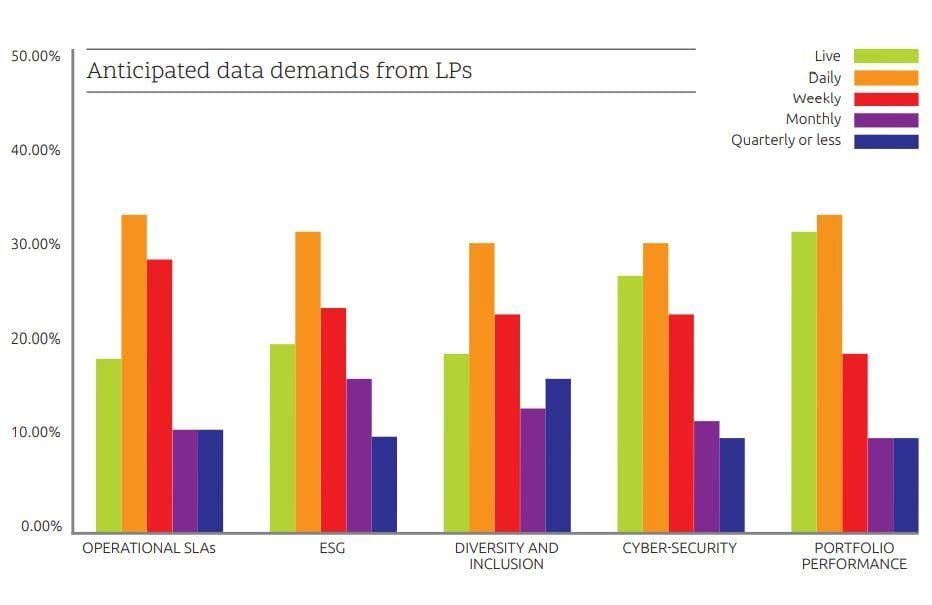

According to the research, undertaken in late 2020-early 2021 in collaboration with Global Custodian, CFOs expect LPs to require data updates on specific areas of service much more frequently. Indeed, 64% of CFOs globally expect live or daily portfolio performance information to become the norm in the years ahead.

And demand for data doesn’t stop there. More than half (57%) of CFOs expect to become responsible for daily or even live cyber data reports. CFOs also see greater demand for ESG reporting and service-level agreements (SLAs) – 51% and 50% respectively.

To put this into perspective, Intertrust Group estimates that $5.5bn will be invested globally over the next five years to help tackle the rising demands that LPs make of CFOs.

So what help can be provided? We already receive requests to handle special projects on issues such as profit and loss, or specific requests about the reconciliation of a portfolio. For some companies, a fractional CFO – engaged to provide strategic leadership and experience on a part-time or project basis – may be needed along with administration services to provide sector expertise or as an extra pair of hands.

After all, those general partners (GPs) able to show their LPs that they have third-party oversight on record keeping, cybersecurity, ESG jurisdictional compliance and reconciliation services are most likely to gain market share.

Source: Global Custodian in partnership with Intertrust Group, 2021, ‘The future private capital CFO: Evolving in a digital age’

Data demand may bring new fee structures

CFOs undoubtedly feel the pressure of providing the quality and quantity of reporting their founders and LPs expect. And this increasing demand for data will stoke debate over the management fees GPs can reasonably charge above the standard 2%.

We might, for example, see different classes of services and fee structures develop for LPs wanting daily versus live reporting.

Until ESG data sets, for example, are standardised industry-wide, LPs will have no choice but to demand bespoke information. Providing this level of service for each LP will put considerable drain on portfolio companies and GP resources. But this strain may well prove profitable if increasingly robust ESG milestones prompt stronger portfolio performance.

Companies such as Intertrust Group can gain a lot by developing in-house technology solutions to meet our changing investor profiles.

For example, our Centre of Excellence in India has developed a digital solution to provide Know your Customer (KYC) and Anti-Money Laundering (AML) services for clients with a growing number of retail investors. We have also integrated a plug-and play solution for a crypto fund client, allowing them to validate assets in crypto wallets. This sort of automated technology allows services to improve while keeping costs down.

But can GPs of emerging funds or even special purpose acquisition companies (SPACs) sustain the extra time and costs required for daily and bespoke reporting without help?

All these added responsibilities may already be keeping some CFOs awake at night. What could sweeten their dreams is a symbiotic CFO-CTO relationship or even help from an outside consultant. It’s not easy being the Chief Financial Officer of Everything.

How Intertrust Group can help businesses

- We have breadth, end-to-end ability and give LPs and GPs a unique review of their funds.

- We are the largest provider of special purchase vehicles (SPV) to the private equity market, administering 18,000 across the world’s main fund centres.

- We are the only central bank-licensed escrow service provider in Europe experienced in facilitating SPACs. Our tailor-made escrow agreements are geared to service cross-border transactions, governed by the laws of many key jurisdictions.

- We provide cutting-edge technology for end-to-end fund administration platforms.