Cliff Pearce

Global Head of Capital Markets, Group

View bio

Cliff Pearce

Global Head of Capital Markets, Group

Cliff is responsible for building Intertrust’s unique global offering of capital market solutions. He has over 20 years’ experience working in the Capital Markets for a number of top tier banks including Greenwich Natwest, Bear Sterns and most recently Bank of America Merrill Lynch, originating and delivering structured finance transactions to a wide range of clients.

Cliff’s recent experience includes term ABS transactions for the primary markets, fund finance, senior secured asset backed lending facilities for a range of asset classes, whole loan sales of mortgage and loan portfolios including performing and non-performing loans, managing legacy asset positions and ABS and high yield bond broker.

CloseUS SPAC teams will arguably have the upper hand when hunting for assets in Europe. Here’s why.

The potential feels almost palpable for those capital markets and investors that can spot it.

Having fuelled the frenzy of US Special Purpose Acquisition Companies (SPACs) on home territory over the past year, that potential now looks set, slowly but surely, to up the pace in Europe, namely on Amsterdam’s Euronext.

So what are the key attractions for US SPAC teams looking to Europe?

Dealmakers and bankers find the Netherlands’ flexible listing rules – similar in nature to those of the US – and its highly experienced financial and legal advisers ideal for SPACs.

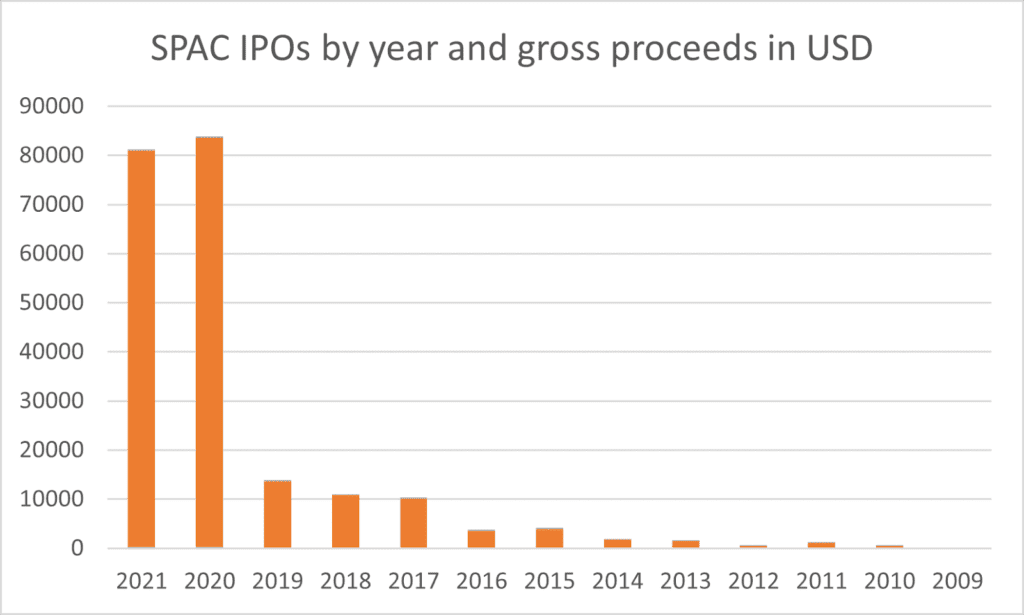

Chart Source: SpacInsider

The frequency and speed of US SPAC listings over the past year has proven the eagerness of investors to deploy their capital into the hands of innovative and capable managers with a high probability of achieving a yield above 8% (the private markets’ gold standard hurdle rate, or lowest ROI deemed acceptable for the risk).

What has yet to be seen on a sizeable scale is the track record of de-SPAC returns or dividend yields post-dilution – after the target company has been acquired or merged and the early SPAC investors have cashed in.

There are signs that SPAC mergers in 2019-2020 outperformed those in 2016-2018, according to a July 2020 Nasdaq report. Is this due to the calibre of managers launching SPACs in 2020? The jury is still out.

Of the 222 SPAC initial public offerings (IPO) from the start of 2015 to mid-July 2020, 89 had completed mergers and taken a company public. Within this group, the common shares had delivered an average loss of -18.8% and a median return of -36.1%, compared to the average aftermarket return of 37.2% for traditional IPOs since 2015, said the Nasdaq report.

Size does matter here. Larger SPAC mergers have outperformed smaller transactions. While some sectors are coming out as winners, notably healthcare and tech, with SPACs in these fields outperforming in this period, others, such as energy, have underperformed.

The energy sector is not homogenous though, with cleantech and renewables focused SPACs launched from 2020 onwards facing quite different prospects to traditional fossil fuel energy assets.

With the EU’s sustainable finance disclosure regulation (SFDR) imposing strict disclosure requirements from 10 March 2021, assets with a strong ESG focus are in increasing demand from European-based limited partners.

Do US SPAC teams have an upper hand?

The lack of proof on returns for SPACs launched in 2020 could be an easier pill to swallow if SPAC teams and investors knew they were entering an environment where they had the upper hand.

This is where Europe’s less mature and less saturated SPAC market becomes an opportunity for US SPAC teams.

At $32.12 trillion, the S&P 500 market cap has outgrown the London Stock Exchange (LSE) and Euronext market caps nearly sevenfold, fuelling a presumption that companies in the UK and elsewhere in Europe are undervalued.

By the end of 2020, the total market capitalisation of companies on the Euronext stock exchange reached nearly €4.41tn. The luxury goods company LVMH, which consists of Louis Vuitton, Moët and Hennessy, for example, had the highest valuation, with a market capital value of almost €257.9 billion as of the end of 2020. The computer hardware company IBM was second, with a market capitalisation of approximately €212 billion, according to YCharts.

Is Europe selling itself short?

Arguably European asset owners and LSE and Euronext listed companies may not know what they’ve got until it’s gone, to use the common phrase, or in this instance until it has been acquired by a US SPAC team.

What better way to boost a SPAC management team’s chance of achieving returns far above that 8% than to hunt for deals in markets that historically undervalue companies and where capital markets have yet to find a formula that prices in growth and innovation in the early-stage technology sector.

SPAC classification at this early stage in the asset class’ re-emergence is largely industry agnostic and opportunistic in nature. Certainly, some SPACs are targeting certain sectors, such as fintech, e-commerce and renewables. Intertrust Group client Infestos Sustainability took an industry-agnostic approach with an environmental, social and governance (ESG) focus in its €250m ESG Core Investments SPAC. This was Amsterdam’s first listing for 2021 and Euronext’s first ESG-based SPAC.

The FT1000, a ranking of Europe’s fastest-growing companies, reporting in conjunction with research company Statista in 2020, states that hundreds of European companies achieved a compound annual growth rate in revenue of 35.5% or higher between 2016 and 2019.

Italy has the most entries on their list, with 269. Germany follows with 204, and then France with 162. London is the city with the greatest number of fast-growing companies (71), followed by Paris (45) and Milan (36).

While not in the business of crystal ball gazing, at Intertrust Group we do anticipate some US SPAC team activity among Europe’s privately held technology unicorn companies (those that are gaining scale and are valued at $1bn or more). Crunchbase is tracking funding rounds of 42 European unicorns including Bulb Energy, Hopin, Starling Bank, Zego and Atai Lifesciences, to name just a few.

This targeted SPAC deal activity towards unicorns will be driven not by sub-sector preference but will rather be opportunistic by design. These mythically named companies and their founders are particularly attractive to high profile SPAC teams because they have something in common with each other: a compelling growth story to tell institutional and retail investors.

Whether that story has a happy ending is still being worked out – which provides US and European financial regulators time for reflection on how to craft the best possible outcome for all parties involved.

Why Intertrust Group?

- Intertrust Group’s local knowledge and flexibility could prove cost-effective should your funds be exploring Special Purpose Acquisition Company transactions either to purchase or to realise through an exit.

- We are the largest provider of special purchase vehicles (SPV) to the private equity market, administering 18,000 across the world’s main fund centres.

- We are the only central bank licensed escrow service provider in Europe experienced in facilitating SPACs. Our tailor-made escrow agreements are geared to service cross-border transactions, governed by the laws of many key jurisdictions.

- We are able to act as a Listing and Transfer Agent on The International Stock Exchange (TISE).

- We have breadth, end-to-end ability and give limited partners and general partners a unique review of their funds.