RMB funds are surging in popularity following the lifting of restrictions for foreign companies setting them up inside mainland China. Here, Derek Tsoi, commercial director, fund services, and Shuting Li, senior manager, fund services, look at the trends and examine the challenges faced by clients

China is increasingly a top global investment destination – and recent moves by the Chinese government to relax restrictions have bolstered foreign direct investment (FDI).

RMB funds have been issued since 2005, but they are currently gaining popularity following the lifting of restrictions for foreign companies setting up funds in mainland China.

Foreign investment has also been given a boost since 2010 by the release of the Shanghai government’s Qualified Foreign Limited Partner (QFLP) pilot programme as well as the Private Fund Management (PFM) programme in 2016.

These initiatives have led to a significant increase in fund formation. Between 2014 and 2021, the number of private equity transactions per year in China rose from 943 to 5,262.[1]

Despite the effects of the Covid pandemic, the increase has continued. In July 2022 the number of managed funds was 135,836, an increase of 2,039 (1.52%) on the June figure. In the same period, the size of the funds grew by RMB 420.09 billion to RMB 20.39 trillion, an increase of 2.1%.[2]

As a result of this growth, there is a new demand for fund administration support in China.

How can foreign investment managers set up RMB funds in China?

Figures from the Asset Management Association of China show that demand for these funds has been growing steadily. Despite difficulties experienced recently by the Chinese economy – and tensions between the US and China – there is still clear interest from global investors and investment managers.

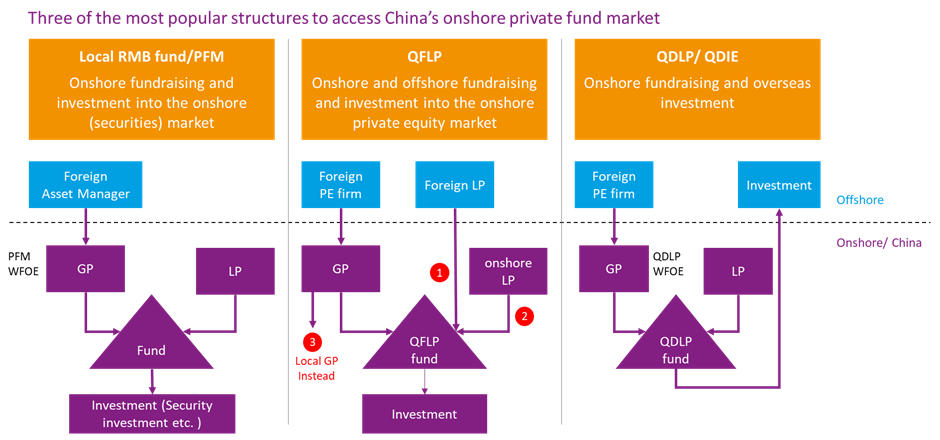

There are three routes to investment by foreign entities:

- Local renminbi (RMB) fund

- The Qualified Foreign Limited Partnership (QFLP) system, which allows foreign investors to invest in Chinese entities

- The Qualified Domestic Limited Partnership (QDLP), which allows foreign fund managers to market offshore investment products to Chinese institutional investors and high-net-worth individuals (HNWIs)

The QFLP and the QDLP are popular ways to utilise resources across borders, enabling capital inflow and outflow into the Chinese markets.

At the recent conference hosted by The Hong Kong Venture Capital and Private Equity Association (HKVCA) in Hong Kong, we examined the growth in RMB funds during a panel discussion.

What are the challenges associated with fund formation in China?

While new inflows of foreign capital are a positive move, this involves many different government and provincial regulations, which is why fund managers may look to work with third-party service providers in ensuring their entities are compliant.

Regulations and incentives are subject to rapid change and investment managers need to stay up-to-date with the most recent policies to help them select the most beneficial legal structures. The initial set-up period is often essential and includes lengthy form-filling processes in Mandarin and forms that need to be filed in person. For investment managers with little or no operational teams presented locally, this is often hard to complete.

Another key consideration is the need to find continuity in administrative support throughout the life cycle of the fund – from fundraising, investment and portfolio management to exit – which can often span 10 years.

In some cases, it can be hard to source a third-party provider with a good reputation and track record against reasonable cost.

A partner needs to have the expertise to understand the complexities between different provinces and cities and be able to engage with multiple local providers. They need the size and experience to provide continuity and work with fund managers over a long period.

They also require understanding to keep up with new policies and incentives and to help fund managers maintain clear corporate governance and an overview of their entities.

The benefits of a third-party fund service provider

In addition to ensuring that fund managers are compliant with global regulations and requirements such as anti-money laundering (AML) and Know Your Customer (KYC), a good third-party fund service provider can help navigate local regulatory complexities in China that are specific to each province. They can also provide independent financial reporting documents that will ensure figures are reliable and credible.

Outsourcing fund administration support services can also free up fund managers to focus on generating returns rather than spending time and resources on running day-to-day operations.

How Intertrust Group can support you in China

Intertrust Group has a well-established footprint in China. More than 70 staff across four offices in key mainland cities – Beijing, Shanghai, Guangzhou and Shenzhen – are ready to support global investors. The mainland teams work closely with our Hong Kong office to offer best-in-class, tailored solutions for new clients.

We provide onshore end-to-end support, working with legal counsel to set up a fund and other fund-related entities, and providing administrative support services to maintain daily operations throughout the fund cycle while maintaining compliance in this complex, developing market.

Why Intertrust Group?

- Intertrust Group is a publicly listed company with more than 70 years’ experience in providing world-class trust and corporate services to clients around the world.

- Intertrust Group provides a wide range of financial and administrative services to clients operating and investing internationally. We help companies to expand globally, offering support with restructuring, outsourcing and further developments.