CSC Corptax® Account Manager Beth Graves works with tax teams that occasionally use loan-staffing or co-sourcing to bridge temporary labor gaps—and with clients that have fully outsourced a tax process. In the interview below, Beth shares what she’s learned based on her customers’ outsourcing experiences.

When tax professionals need outside help, what should they think about first?

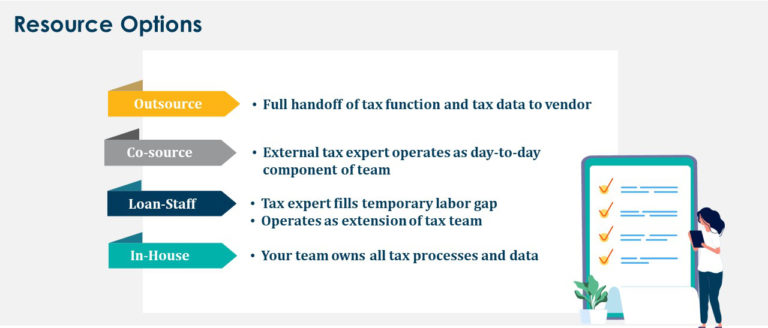

Before anything else, it’s important to determine the kind of help you need: loan-staffing, co-sourcing, or outsourcing. If it’s a temporary labor gap, consider bringing in experts to help you through the crunch-time. Loan-staffing is a quick and cost-effective short-term solution. You maintain your data and keep your systems and workflows intact while you work alongside experts who supplement your team. Be sure to check with your software provider—they may offer loan-staffing services, and they already know your software.

Co-sourcing may be a viable option for more significant or longer-term staffing needs—for example, if legislative changes leave you challenged. You keep your data and software in-house and give a third-party access to provide the level of assistance you need. Sharing data and output ensures a seamless process between resources. You can use your system to run reports, get answers for current and future audit inquiries, and participate in any part of a tax process, such as returns, provision, estimates, or extensions. By owning your data and software, you stay responsive and in control.

Outsourcing generally entails fully handing off your company’s tax data to an outside accounting firm, and they complete your filing requirements. You may have limited involvement—such as providing information for data requests—but the firm typically executes the work and the review process. Because accounting firms use various technologies, your data will likely be converted to their tool of choice, and you may not have access to current or prior-year data. With your data out of touch, you must rely on the firm to assist with analytics and inquiries.

While outsourcing can seem like a total solution, there’s a lot to think about that isn’t always immediately apparent.

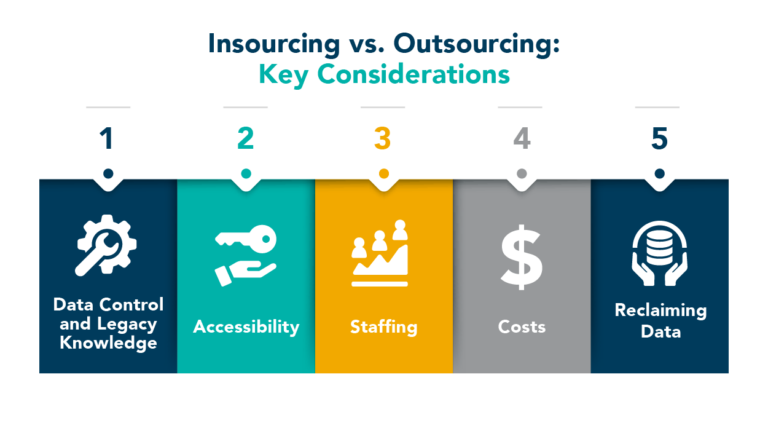

What are some key considerations when thinking about insourcing vs. outsourcing?

1. Data control and legacy knowledge: It’s important to consider the benefits of maintaining control of your data. You and your staff have built valuable legacy knowledge through the years, so you know your data and the inner workings of your company more intimately than a third party can. If questions come up from external auditors, CFOs, CEOs, or whoever signs the return, you know whom to go to and where to find the information. You know about past transactions, why you took certain positions in the return, and so on. It’s faster and easier to respond with accurate answers.

2. Accessibility: Keeping your data and software in-house puts information at your fingertips. You have immediate access to your tax system to examine and query data and to create dashboards and share insights. Providing digital audit support is vital, and having technology and staff in-house helps you respond to requests efficiently, accurately, and cost-effectively. Imagine if you outsource your tax return, and two years down the road you need to answer an audit request on that data. Will your outside preparers have the same tax staff doing your work two years later? Maybe, but not likely. Someone there will need to go back and refresh themselves with the data to understand what happened and why, so they can prepare an audit response. And most likely, they’ll charge you for that.

Take that scenario one step further. Let’s say you no longer outsource when you get that audit request. Now you may need to reconstruct the return using documentation from someone who may not have documented the same way you do.

3. Staffing: Outsourcing can be seen as labor-saving, but you still need staff members to assemble data for the firm. For example, a firm typically can’t access your general ledger team to get trial balance downloads. You’ll also need to help if they need details for trial balance items, or if they need to know the particulars of a transaction or book entry.

Your tax team has relationships with other internal departments, like payroll, general accounting, and fixed-assets accounting—all the groups that feed into a return or provision. You build and leverage those relationships as part of your job. When I worked in industry, my financial accounting counterparts would say, “Hey, heads up. This transaction is happening, and here’s how we’re treating it, so you may need to adjust for it going forward.” When you outsource, you lose that benefit because who’s going to call your provider to relay this kind of valuable information?

And along those lines, outsourcing firms may appreciate you as a client, but your own employees have true personal ownership. An employee is more likely to dig deeper to understand a transaction and report it properly as they prepare a return. An accounting firm may take data at face value because they don’t have historical knowledge or the ability to have internal dialogues.

4. Costs: Be careful assuming that outsourcing will generate cost savings. Quite often, outsourcing ends up costing significantly more than initially planned. Unexpected items almost always come up and get tacked on to the engagement. It’s hard to know everything you’ll need or want until you’re well underway and start uncovering those “gotchas”. Before you know it, outsourcing fees have crept up, chiseling away expected savings.

On the flip side, if you license technology, your costs are fixed. And optimizing that technology delivers efficiencies, allowing you to redirect your time to value-added tasks that can be financially advantageous to your company.

5. Reclaiming data: Outsourcing firms often use proprietary environments, so if you decide to take your tax processes back in-house, and the firm provides your most current dataset, it may no longer sync with your system. In addition, there will likely be new entities, new accounts, and new adjustments to incorporate. In these scenarios, companies may need to reimplement their software solution. And what about the years that were outsourced? Typically, that data stays with the outsourcing firm, so you remain tethered until all audits are closed.

When does outsourcing make sense?

There are absolutely times when outsourcing makes sense. If a company physically moves its office from one state to another, and employees opt not to transfer, the work has to be done and returns must be filed. Outsourcing while you hire staff may be your only option. Or, if there’s a spin-off and either the existing or new company isn’t fully staffed up, you may need to farm out work. Co-sourcing or short-term help may not suffice until new people can be hired, so outsourcing presents a logical, temporary option.

Any final thoughts on insourcing?

The key for an in-house tax department is to use its technology to full capacity, so you can optimize tax operations. If you integrate, automate, and streamline, you have more time to strategically analyze data, plan tax work, and participate in business decisions that ultimately save money or increase cash flow for your company. Basically, you become a profit center instead of a cost center. That is huge and not something you get when you outsource. Companies should thoroughly consider both the current and long-term costs and benefits of all options before deciding on the best solution for them.

Owning your data helps tax teams drive value. Learn how in the ebook: 8 Reasons to Keep Your Tax Data In-house

about this topicAbout Beth Graves

A CSC Corptax® Account Manager, Beth Graves cultivates and manages relationships with large Corptax clients to ensure their solutions, services, and customer support meet their needs. She holds a Bachelor of Science degree in accounting from the University of Houston.