We talk “tax technology” with tax teams on a daily basis. They often tell us, “…we know we should implement technology, but it’s hard to prioritize when we work ’til 9:00 every night.”

Well, if you work until 9:00 every night, tax technology is the best way to break that cycle.

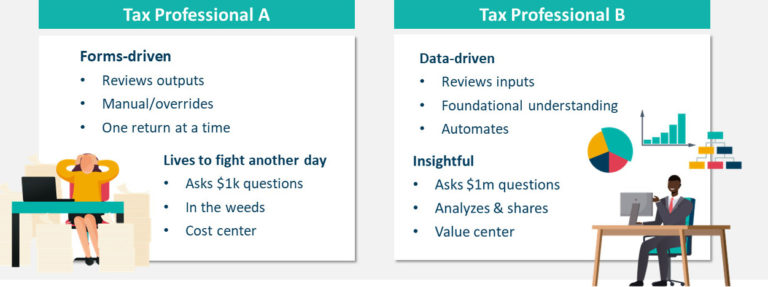

To illustrate what we mean, let’s quickly compare how two tax professionals approach their work. Tax Pro A relies on manual processes, while Tax Pro B uses dedicated tax technology.

Work smarter, not harder

Tax Pro B automates repetitive processes. Automation not only reduces stress and human error, it frees up time. Now, Tax Pro B can focus on big-picture thinking and ask $1m questions. Meanwhile, Tax Pro A is deep in the weeds reviewing returns at the 11th hour and sorting out $1k variations.

Tax Pro B uses analytics to support the review process—and develop expectations. When it’s time to review the return, it’s simply a matter of comparing and confirming expected vs. actual results.

By contrast, Tax Pro A spends tons of time reviewing forms—poring over one PDF at a time—and going back to the system to manually override numbers when they don’t tie out.

Once filing season has come and gone, Tax Pro A responds to notices and tries to figure out what went well and what went poorly. Tax Pro B is already fine-tuning next year’s process and aiming to file a couple of months sooner.

In short, Tax Pro B is a value driver. Technology helps the department strengthen their partnership with company leadership. Tax Pro A is a cost center, working long hours and living to fight another day.

Take the plunge

Implementing tax technology is easier than you may think and brings enormous benefits. We’re here to help you see what’s possible! Give us a call at 800.966.1639 or contact info@corptax.com.

Considering tax software? Read 5 Reasons NOW Is the Time to Make a Case for Tax Technology

about this topicAbout Beth Graves

A CSC Corptax® Account Manager, Beth Graves cultivates and manages relationships with large Corptax clients to ensure their solutions, services, and customer support meet their needs. She holds a Bachelor of Science degree in accounting from the University of Houston.

About Carter Bulter

As CSC Corptax® Product Marketing Manager, Carter Butler is a liaison between tax professionals and internal Corptax teams. He helps tax teams make informed decisions about improving their tax processes using tools that simplify daily work and furnish work-life balance. A former tax professional with PricewaterhouseCoopers LLP, Carter used Corptax solutions every day. He is a licensed CPA and holds a M.S. in accounting from University of New Hampshire.