The Norwegian Register of Beneficial Owners opened for registration on October 1, 2024. This change means that private limited liability companies and branches operating in Norway will need to register information about their beneficial owners by July 31, 2025. This article provides an overview of the key information surrounding this change.

What is The Norwegian Register of Beneficial Owners?

The Norwegian Register of Beneficial Owners is a new public register for identifying and reporting beneficial owners of businesses in Norway.

Who does it apply to?

All businesses and legal entities operating in Norway must comply.

What needs to be done?

Beginning October 1, 2024, Norwegian businesses and entities are required to register ultimate beneficial owners (UBOs). Registration is required to be completed by July 31, 2025.

What is an Ultimate Beneficial Owner?

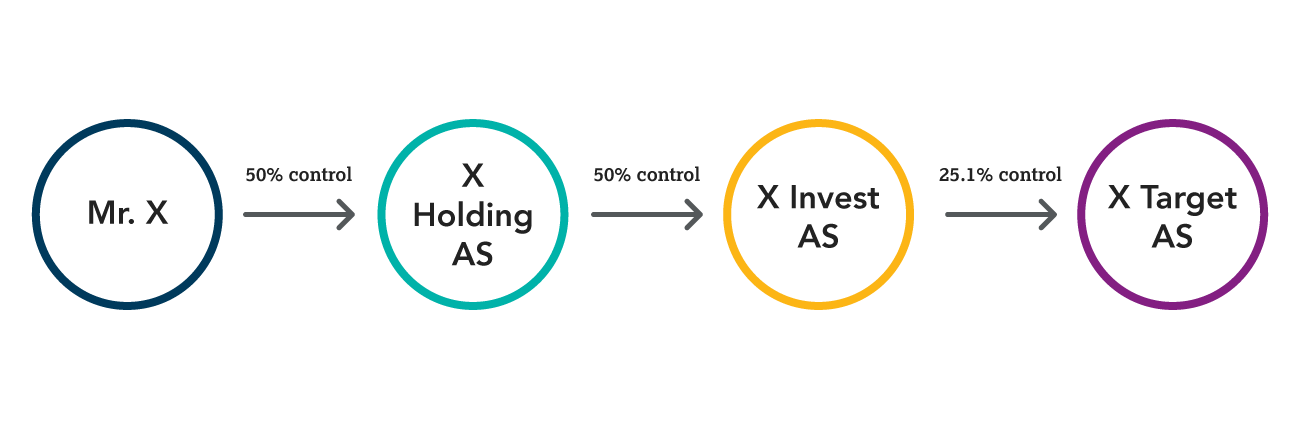

A UBO is a person who controls a sufficient share of a business and has sufficient control in the business required to register beneficial owners. To be considered a beneficial owner, a person must indirectly control more than 25 percent at the first level, and then indirectly control 50 percent or more at subsequent levels*.

What if there’s no UBO?

Even if no UBO exists, or if UBOs cannot be identified, companies are still required to submit the relevant form to comply with the new update.

What information is required for registration?

The following is mandatory information required for registration:

- Full name

- Norwegian personal identification number or D-number (If a UBO does not have a Norwegian ID or D-number, their birth date should be registered).

- Country of residence

- All citizenships

*The definition of a UBO in the Register of Beneficial Owners differs from the definition in the Norwegian Anti-Money Laundering Act, so UBOs identified during our onboarding or file review may not need to register.

Indirect Beneficial Ownership Rules and Paths

| First Level | Subsequent Levels |

| – Ownership > 25% – Voting rights > 25% – Right to appoint/remove > 50% of the board – Influence/control in another way | – Voting rights ≥ 50% – Right to appoint/remove > 50% of the board |

| Through an intermediate business |  |

| Through intermediate businesses at several levels |  |

| Through consolidation/merging of rights |  |

How can CSC assist?

Navigating these requirements can be complex, and we’re here to help. We’re happy to handle the entire registration process on your behalf. Our services include:

- Identifying UBOs in line with the definition in the Register of Beneficial Owners

- Preparing and submitting the required information to the Register of Beneficial Owners

- Ensuring compliance with all relevant regulations

Do you want to ensure your business is fully compliant with the UBO register? Let us take the lead to stay ahead of regulations and contact us now.