A series of high-profile cases in which institutional investors failed to recognize and understand performance fees has generated renewed interest about distribution waterfalls and how they affect returns.

While waterfalls can exist in hybrid form or reflect variations and modifications that impact the way returns are distributed, there are technically only two methods of calculating distributions: the European and the American waterfall.

The two methods typically differ in terms of how they deal with the timing and allocation of distribution proceeds to general partners (GPs) and limited partners (LPs). However, the proceeds are the same; it’s only the timing that differs.

In this blog, we examine the two basic methods into which distribution waterfall schedules for private capital are classified.

American vs. European waterfalls in brief

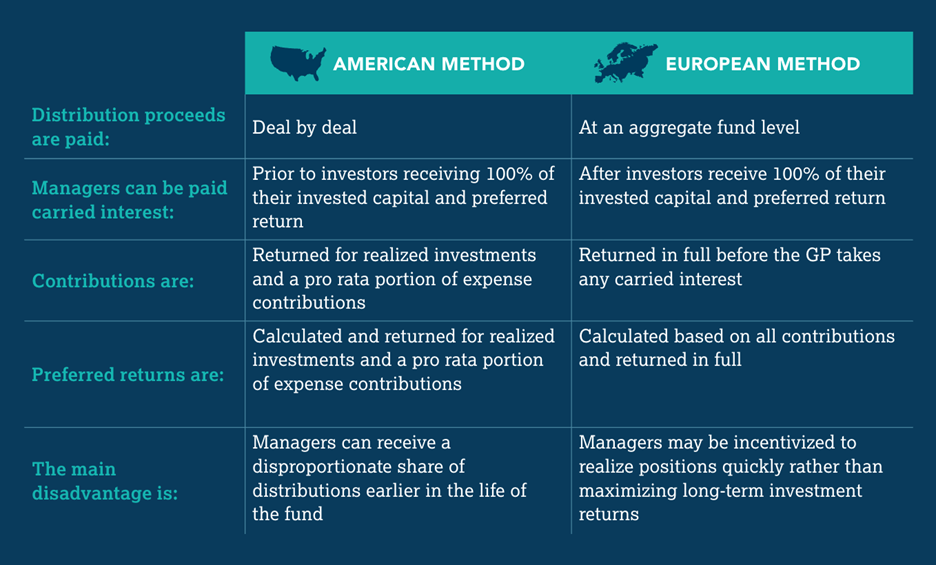

The American waterfall supports a deal-by-deal return schedule that allows managers to get paid before investors receive all their invested capital and preferred return. The distribution proceeds are generally allocated on a deal-by-deal basis. As a result, performance is tied to each individual investment. This method is more beneficial to the GP in the earlier years as it distributes carried interest faster by making the carry payable with respect to each investment that gets the fund to a net-cumulative-profits-to-date position. In this type of deal-by-deal waterfall, the first deal may return some carried interest if the deal’s internal rate of return (IRR) is above the preferred return.

The European waterfall determines the allocation of the distribution proceeds at a whole fund level, and each distribution reflects the aggregate performance rather than being tied to an individual investment. The carried interest is determined on a net cumulative basis and distributable to the manager only after a full return to the investors of their contributed capital and preferred return. With a European waterfall, the first distributions typically return all the contributed capital.

The pros and cons of each waterfall method

For LPs, the drawback with an American waterfall is that while this waterfall still entitles the LP to a preferred return and their return of capital, it’s structured so that a manager could receive a disproportionate share of cash flow early in the fund’s life cycle if there are significant early exits.

In a European waterfall, 100% of the contributed capital and preferred return is paid out to investors on a pro rata basis before the GP receives any distribution of carried interest. Because it’s pro rata, all capital is treated equally, and distributions are paid out in proportion to the amount of capital invested.

One potential drawback of this method for the LP is that managers may realize positions quickly to receive distributions rather than maximizing long-term investment returns. Also, due to the delayed compensation, the European waterfall may also make it challenging to attract senior investment professionals to private equity firms.

Waterfall trends and variations

While there are technically two methods of the distribution waterfall, LPs are likely to see many different variations and modifications.

GPs may offer:

- A choice of American vs. European waterfall, with a discounted management fee or carried interest offered to LPs that choose the American waterfall.

- A discounted management fee in exchange for a higher carried interest rate above higher hurdles.

- A hybrid waterfall in which a European calculation is applied until distributions reach a certain percentage, after which they are distributed according to the American waterfall.

- A modified American waterfall in which:

- Write-downs as well as write-offs are included in the calculations.

- All expenses and preferred return are distributed before carried interest is paid.

- Carried interest or interim clawback is modified to be based on the unrealized waterfall position.

Dive into the details

While the waterfall has often been seen as an impenetrable black box, understanding its impact doesn’t have to involve complicated analysis or a complete recalculation. As GPs commit to greater transparency and data-sharing, there are fewer excuses for maintaining a hands-off approach to waterfall calculation.

Brush up on the fundamentals of distribution waterfalls. Read Waterfalls 101: Distribution Basics for Limited Partners, the first blog in this series.

For more insights into waterfall methods and a sample spreadsheet for calculating both American and European distribution waterfalls, download the CSC insight report, Distribution Waterfalls: The Definitive Guide for Limited Partners.

Why CSC

CSC provides tailored administration and strategic outsourcing solutions to support the complex operations of alternative asset managers across jurisdictions and asset types while adhering to global regulations and compliance. A market leader, we work with funds of all sizes, from start-ups to the largest and most experienced fund managers in the world. Founded in 1899, CSC prides itself on being privately held and professionally managed for more than 120 years. We are the trusted partner of choice for more than 90% of the Fortune 500® and more than 70% of the PEI 300. CSC has office locations and capabilities in more than 140 jurisdictions across Europe, the Americas, Asia Pacific, and the Middle East. We are a global company capable of doing business wherever our clients are—and we accomplish that by employing experts in every business we serve. We are the business behind business®. Learn more at cscgfm.com.