Investing is about returns. In private equity, how those returns are distributed to investors is dictated by the waterfall provisions of the limited partnership agreement (LPA).

Many investors have been paying less attention to this important calculation than they should, mainly because of the complexity of the calculation and the difficulty in getting enough detailed information to review it for reasonableness. This blog dives into the essentials of distribution waterfalls, including a basic definition and a description of the key components.

The importance of distribution waterfalls

While most limited partners (LPs) have developed a level of comfort and familiarity with the more straightforward calculations used to determine management fees, the distribution waterfall is more complicated and nonstandard. This can take even the most seasoned LP out of their comfort zone.

Despite the challenges, LPs are taking the plunge and wading deeper into waterfalls to understand and project their impact on investment returns. The sense of urgency has been spurred on by recent cases in which high-profile institutional investors failed to recognize and understand performance fees charged by the general partner (GP). Across the board, LPs are becoming more rigorous about monitoring their investments and raising potential issues with their GPs.

The work of industry bodies such as the Institutional Limited Partners Association (ILPA) and standards such as the Global Investment Performance Standards (GIPS®) is supporting this shift toward more active oversight. By encouraging greater transparency around investment data, these organizations are helping to break open the “black box” and giving LPs the information they need to understand and monitor the waterfall.

Distribution waterfalls: A basic definition

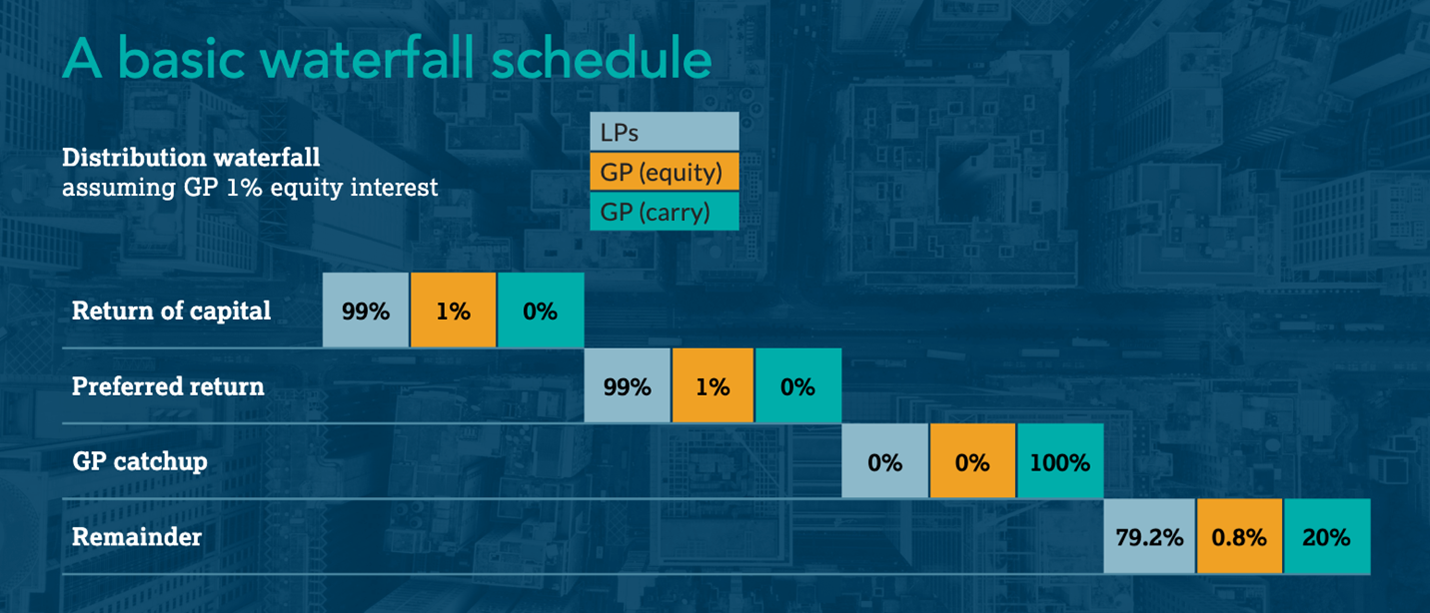

A distribution waterfall defines the way the profit of a fund is distributed between the LPs and the GP. It also defines the distribution of carried interest to the GP once the threshold return is exceeded.

Essentially, the total profit is distributed according to a cascading, tiered structure that gives the waterfall its name. When one tier’s allocation requirements are satisfied, the excess funds are allocated according to the requirements of the next tier, and so on.

Typically, distributions flow to the LPs first in order to return contributions plus a preferred return, after which the distributions are split between the GP and the LPs according to the carried interest calculation.

Distributions can vary significantly, depending on the method of waterfall used, including European waterfalls, American waterfalls, and hybrids and variations of these types that impact the way the returns are distributed.

Given the impact that waterfalls have on returns, it’s important for LPs to understand and be able to review and verify basic waterfall calculations.

Key components of the waterfall

Whether it is modeled on a European, American, or hybrid version, every waterfall calculation includes several key components: return of contributions, the preferred return to LPs, and the carried interest to the GP.

Return of contributions

The return of contributions is generally the first step in the waterfall, with 100% of distributions going to LPs until their capital contributions are recovered.

Preferred return

The preferred return is the profit that is typically distributed to the LP and GP after contributions are returned.

Carried interest

Once contributions and the preferred return have been distributed to the LPs, the carried interest can be distributed to the GP.

Calculating the realized and unrealized waterfall

LPs should calculate the waterfall on both a realized and an unrealized basis. The realized waterfall is calculated at the time of an actual distribution and allocates the actual cash proceeds from investments. It may include written-down and written-off investments. The carried interest includes the actual carried interest paid.

The unrealized waterfall is based on the hypothetical liquidation of the fund as of the reporting date. It assumes that all investments are realized at fair value and the carried interest includes both paid and accrued amounts. The accrued carried interest is typically shown as a reallocation line in the “Statement of Changes in Partners’ Capital” in the fund’s financial statements.

Take a deeper dive

By understanding distribution waterfalls and their key components, you can better understand how they will impact your distributions and capital account at every step.

For even more insights into waterfalls and a sample spreadsheet for calculating both American and European distribution waterfalls, download the CSC insight report, Distribution Waterfalls: The Definitive Guide for Limited Partners.

Why CSC

CSC provides tailored administration and strategic outsourcing solutions to support the complex operations of alternative asset managers across jurisdictions and asset types while adhering to global regulations and compliance. A market leader, we work with funds of all sizes, from start-ups to the largest and most experienced fund managers in the world. Founded in 1899, CSC prides itself on being privately held and professionally managed for more than 120 years. We are the trusted partner of choice for more than 90% of the Fortune 500® and more than 70% of the PEI 300. CSC has office locations and capabilities in more than 140 jurisdictions across Europe, the Americas, Asia Pacific, and the Middle East. We are a global company capable of doing business wherever our clients are—and we accomplish that by employing experts in every business we serve. We are the business behind business®. Learn more at cscgfm.com.